Financial independence is when your assets generate sufficient passive income to pay for your expenses.

Financial freedom is another term used interchangeably with financial independence. When one attains financial independence, they don’t have to work to earn income. Their income is passive, meaning it requires little to zero effort on their part to generate it.

Why is Financial Independence Important?

No one can work forever! Unfortunately, most people tend to continue working actively to earn money even when they should be retired and living off passive income.

Financial independence lets you focus on the most important things in your life, so you don’t get tied down by active work.

Nearly everyone dreams of financial independence, but achieving it is not an easy feat. It is one of those goals that usually take some time, commitment, and consistently working on a proven strategy.

While this usually comes off as hard work, there are things you can do right now to place yourself on the right track. One of the tried and tested methods of attaining financial independence is real estate investing.

Before highlighting how real estate investing can help you attain financial freedom, it is important to first look at what it is, its preconditions, and of course, definitions.

The Link Between Financial Independence And Real Estate Investing

Many people assume that you can move from being financially dependent to financially independent, but that couldn’t be further from the truth.

You must see financial independence as a dynamic and fluid goal. In other words, it comes with various stages. The first stage is where you can cover your basic living expenses. The second and third stages deal with expenses of luxury and comfort, building on the fundamentals of the first stage and achieving true financial freedom.

A common misconception is that you have to be at a certain age to become financially independent. That simply isn’t true as there is no age barrier to becoming financially free. In other words, you don’t have to reach the traditional retirement age before you consider passive income.

Recent statistics show that young adults and millennials are over 50% more likely to pursue real estate investment opportunities compared to baby boomers or Gen Xers, in their bid for financial independence.

There was a time when you needed a lot of capital to get into real estate investing. However, that is no longer the case since many investment opportunities allow just about anyone to invest in a real estate portfolio. In addition, there are more financing options than ever before, so it is a lot easier to get into real estate investments.

To be a real estate investor, you need to have some available capital as well as good instincts. And while you might not understand everything there is to know about real estate or financing in the beginning, you should be confident to conduct deals within the shortest time and, of course, with some in-depth research.

How to Get Started

Putting Your Finances in Order

Before you consider investing in real estate opportunities to attain financial freedom, you must ensure that your finances are in order. You must have as little debt as possible, and you must pay your bills on time.

For example, if you have a car loan or credit card debt, it might be advantageous to pay them off before beginning your journey to financial independence. That’s because it is usually not a sound financial strategy to pay interest every month and carry credit card balances from one month to the next. As soon as your financial situation is in order, you can begin saving money for investment purposes and to reach your personal finance goals.

The first step is to save whatever is left after taking care of your monthly expenses, whether it’s 10, 20, or even 40% of your take-home pay after tax, assuming that you have a regular job. However, if you generate income from additional sources, you can put them aside in a savings account.

Once you’ve taken these steps, you can begin to look at prospective real estate investment opportunities.

Getting Your First Property

Considering you are just starting your journey to financial independence and real estate investing, you might be unsure how to choose your first property.

One of the most logical and easiest ways to start a real estate investment is to buy a rental property that you can also live in. For example, a multifamily building, duplex, or apartment building that you can rent out while living in one of the units, so you don’t spend money on another home.

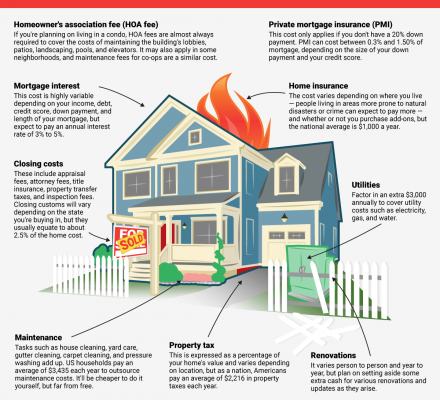

You must make a down payment of at least 5%. For your first investment property, though, you should always put down about 20%.

There isn’t a limit to how much you can pay down. Keep in mind that putting down a larger percentage of the down payment not only helps you get an improved interest rate but can also eliminate the need to pay private mortgage insurance.

Financing Options

As a beginner in real estate investing, you are unlikely to have the necessary cash reserves to buy properties without borrowing money from the bank or other financial institutions. Depending on your situation, there are a plethora of loan options you can choose from, such as the United States Government Department of Agriculture loans (USDA), Federal Housing Authority loans (FHA), and Veterans Affairs loans (VA).

The US federal government typically insures these loans. You must meet the strict criteria to access them. For example, to get a VA loan, you must be a veteran and you can only get the USDA loan in some rural areas.

Alternatively, you can seek loans from private lenders, particularly banks that offer anything from portfolio loans to conventional mortgages. The former usually have shorter terms, but the interest rates are low if you can meet the monthly payments.

Best Ways to Invest in Real Estate

Investing in real estate can be done in a few different ways. We’ll only look at the most common options, especially as they relate to the main goal of becoming financially independent. These investment opportunities are:

- Crowdfunding platforms

- REITs

- Rental properties

Real Estate Investing (Crowdfunding) Platform

Many companies connect real estate developers to potential investors looking to finance projects through equity or debt. This arrangement allows investors to receive quarterly or monthly distributions in exchange for taking on a large portion of the risk.

Just as with many other real estate investments, crowdfunding investments are illiquid and speculative, meaning they can’t be easily unloaded the way one would trade shares.

Real Estate Investment Trusts (REITs)

Real estate investment trusts or REITs enable you to invest in real estate without owning the actual real estate. REITs are often compared to mutual funds in that you buy stocks in organizations that own commercial real estate, such as retail spaces, office buildings, hotels, and apartment complexes.

In the end, REITs tend to offer high dividends, making them a popular investment vehicle in retirement. For investors who do not want or need regular income, there are facilities to automatically invest the dividends, which will grow their investments further.

Rental Properties

Consider rental properties as a long-term real estate investment strategy. To become financially independent with this strategy, you need to generate passive income while accumulating additional capital to reinvest.

It can be quite difficult to determine the rental value of an apartment complex or multifamily building, especially if you are new to real estate investing. Thankfully, several models can help you ascertain a property’s potential rental value.

These include gross rent multiplier (GRM), which determines your potential income, and the capital asset pricing model, which evaluates the building’s rental potential against your other investments.

If you decide to include rental properties in your financial strategy, the process is similar to buying a home. Once the property has been inspected and closed, you can improve it and rent it out at its true market value, maximizing your investment.

Of course, you will need tenants to generate any income. But once you do that and start collecting rent, the entire process becomes passive. You can outsource the property management to a service, so you are not actively involved in finding tenants to begin with.

Conclusion

Keep in mind that there isn’t a right way to go into real estate investment, nor is there a correct one-size-fits-all way to become financially independent. The most important thing is that you monitor your finances, and your debt level should be considerably low.

Don’t rush to achieve what is, in essence, a long-term financial goal in a few years. Continue to learn more about financial literacy as you invest and ensure that your investment contributions grow over time in a way that suits your needs and lifestyle.