Buying a new home can be an exciting and daunting task, especially for a new home buyer. Buying a new home is not just a matter of finding the right home and putting in an offer. There are many different aspects to consider when buying a new home. And for those who are used to living in military housing there are some additional costs that you may want to consider.

Buying a new home can be an exciting and daunting task, especially for a new home buyer. Buying a new home is not just a matter of finding the right home and putting in an offer. There are many different aspects to consider when buying a new home. And for those who are used to living in military housing there are some additional costs that you may want to consider.

Am I Financially Ready

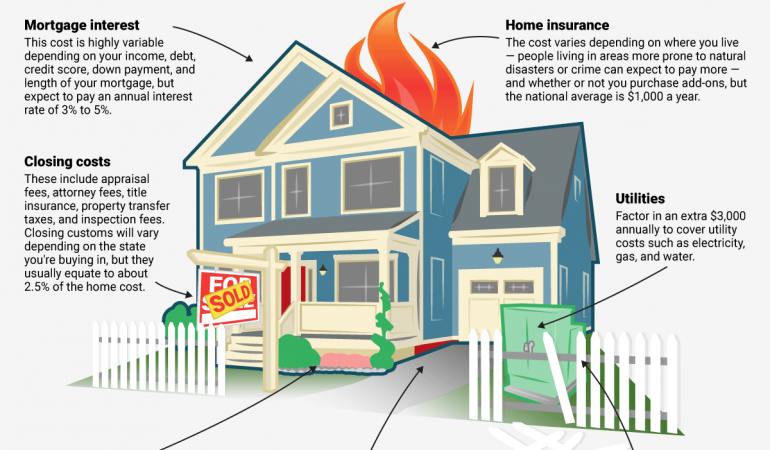

It would be great if buying a new home were as easy as finding the perfect house in the perfect neighborhood, offering a fair price and having it accepted. Unfortunately there are many hidden costs to purchasing a home. Remember besides having to make a mortgage payment which your BAH may or may not cover there is the cost of electric, gas, water, garbage, property taxes, homeowners insurance, and depending on where you buy, homeowner association dues. These are all things that the government normally provides for you when living on a military installation. With the cost of your mortgage and the other incidentals your BAH may be stretched farther than you can manage.

Also it is important not to forget the down payment. Now there are many options out there that make it possible for you to get into a home without a down payment, but what is still required is what is known as earnest money or "good faith money." This is money that you pay to secure the contract. Letting the seller known that you are serious about buying the home. Depending on the contract you sign you may or may not be entitled to a refund if you decide not to go through with the sale.

Some Additional Costs

You will also have to have your new home inspected. There will also be closing costs. Even though closing cost are rolled into your monthly mortgage you still have to pay them. This means that your monthly loan repayment amount may be higher than what you had originally intended.

VA Loans

Once you have reviewed your finances and decide that you are fiscally able to purchase a home you need to request your Certificate of Eligibility for a VA loan. Once you have obtained your certificate your lender will approve your loan (obviously this will still be based on your credit and monthly income). It is also possible for your lender to request your Certificate of Eligibility for you.

On a side note a VA loan is not exactly a loan. That is they do not give you or the lender the money you have been approved for. What a VA loan does is insure the mortgage company you are borrowing from that if you were to be unable to pay your mortgage the VA would be responsible for it.

Buying a new home can be exciting and very rewarding. But often for a member of the military who is used to living on a military installation there can be some added costs that they had not thought of beforehand. The most important things to remember are to get your Certificate of Eligibility and know all costs, hidden or otherwise.