A 1031 exchange is undoubtedly one of the most financially wise ways to defer your capital gains taxes while building wealth. With a 1031 exchange, you can substitute one investment property for another while deferring capital gains taxes. Nevertheless, a 1031 exchange is not exactly straightforward. It can get complicated and consist of strange rules that can make or mar your investment.

When done properly, you can eliminate significant taxes while developing your investment portfolio. If you get it wrong, you will incur a massive tax bill. If you are interested in a 1031 exchange, this article is for you. This article will discuss all you need to know about a 1031 exchange; let’s begin!

What Is a 1031 Exchange?

A 1031 exchange, also known as a Starker exchange or like kind exchange, enables you to switch out one investment property for another. So long as the 1031 exchange is in line with the requirements set out in the Internal Revenue Code Section 1031, you don’t incur any tax bills when you swap. Without a 1031 exchange, you will be required to pay taxes on your current property.

A 1031 exchange is important because it lets you alter the form of your investment. Considering that the exchange is simply a swap, it isn’t recognized by the Internal Revenue Service as a capital gain or cash out. When you swap a property without a 1031 exchange agreement, you make a capital gain from selling that property, a gain that is subject to taxes.

That said, you are still required to pay inspection fees, realtor commissions, insurance, attorney fees, intermediary fees, and other fees associated with selling the original property.

You should also note that a 1031 exchange isn’t tax-free; it is tax-deferred, which means that you will be required to pay taxes eventually should you sell the property for a large sum. Nevertheless, so long as you continue swapping one property for another or something in the asset class, you can keep deferring the tax payment.

What’s also great about a 1031 exchange is that you aren’t limited in the type of properties you can swap. For instance, you aren’t required to trade for a multi-family property simply because you have a multi-family property you want to exchange. You can trade your property for an empty lot, an apartment complex, or even a single-family home.

Find out a more detailed explanation of what a 1031 Exchange is.

Benefits of a 1031 Exchange

There are more than a few benefits of conducting a 1031 exchange; some of the noteworthy ones are:

Estate Planning

Tax liabilities are terminated with death, so if you die without selling the investment property you got via the 1031 exchange rule, your heirs will not be required to pay the deferred taxes. What they inherit instead is the property at its stepped-up value.

Liquidity

You can trade your property for a more liquid asset providing you additional flexibility. For instance, you could change your real estate investment for a property in a rising market.

Depreciation Reset

A 1031 exchange can reset your investment’s depreciable amount to get larger tax benefits for your rental property.

Investment

You get the opportunity to switch out your investment for a more promising property. You could also upgrade said investment, such as switching a single-family apartment for a multi-family unit.

Tax Deferment

With a 1031 exchange, you get a tax deferral, enabling you to grow your long-term wealth when real estate investing.

Steps on How to Do a 1031 Exchange

Conducting a 1031 exchange can be complicated, so working with a licensed professional is best. Nevertheless, the following are the steps to conduct a 1031 exchange:

Understand What Property Qualifies for the 1031 Exchange

To qualify for a 1031 exchange, a property would need to be an investment property. This means you cannot use your vacation home or primary residence.

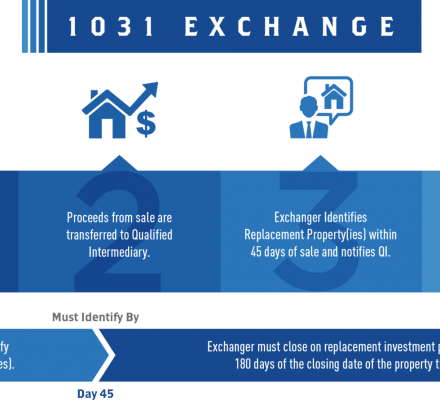

Select an Intermediary

The intermediary will act as an escrow. They will be responsible for receiving the cash generated from the sale of your investment property and using that capital to buy your like kind property. This intermediary ensures you never receive the cash, making a personal gain.

You should also note that while you don’t need to use all the proceeds to purchase your next investment property, you will have to pay capital gains tax on the percentage you keep.

Search for a Like kind Property to Purchase

You will need to find a property with similar characteristics and nature to the one you intend to sell. Furthermore, you will have to get the timing of your sale and purchase right to qualify. This means you cannot use a 1031 exchange for a property outside the United States borders.

Inform the IRS

The IRS Form 8824—responsible for describing the transaction, timeline, properties, and other necessary details of the 1031 exchanges—should be filed with your tax return. Doing this properly ensures that the IRS doesn’t tax the exchange.

That is all there is to the 1031 exchange process in its most basic interpretation. As with all things financial, there are a lot of nuances, special rules, and moving parts that can make the entire process quite challenging.

Difficulties to Be Aware Of

A 1031 exchange can be extremely difficult to conduct. Nevertheless, this doesn’t mean they should be avoided. With that in mind, here are a few things to note:

The Entire 1031 Exchange Process Can Be Complicated

There are so many rules linked with the 1031 exchange that it can make all but the most seasoned real estate investor back out. You must remember all the nuances and rules for a 1031 exchange to succeed. Renting or selling your investment property always seems like the easiest option, even if it might not be the best wealth-growing strategy.

Competitive Market Conditions

Difficult market conditions can make it harder to sell your property, identify a new property, and close all within the IRS stipulated deadline for 1031 exchanges. With properties selling at an alarming rate, securing a like kind property investment can be difficult, particularly when coordinating your property sale.

It Can Be Difficult to Source Financing

It can be difficult to finance 1031 exchanges. This is because most financial institutions do not provide loans for such exchanges, so the entire deal will need to be in cash. This can be difficult to achieve when buying an investment property.

It Can Be Difficult to Locate Appropriate Properties

Finding a like kind property investment suitable for a 1031 exchange can be difficult. This is particularly true because the IRS’s criteria narrow down the type of properties that qualify. This means you could face a massive tax bill when you don’t have an appropriate property 45 days after selling your own investment property.

Here are a few things to bear in mind when searching for a like kind property for investment purposes:

- The property’s market value has to be equal to or greater than the property you sell. It also means you must replace your previous mortgage with a mortgage of greater or equal value, or you have to pay capital gains tax.

- The property needs to be used for investment or business purposes. You cannot purchase a property using a 1031 exchange and then convert it to your primary residence.

- The replacement property has to be within the United States

- It also has to be of the same character and nature. If you trade a rental unit, you must also get a rental unit instead of bonds or shares. Character and nature have no bearing on the quality or grade of the property. This means you can trade a decrepit building for an upgraded one.

It Can Be Difficult to Know When 1031 Is Appropriate

There are times when real estate investors are in a perfect scenario that calls for a 1031 exchange, but they do not know it. One of the most common scenarios is when an accidental landlord—an individual that rents out their primary home after having resided there—becomes the perfect candidate. It isn’t uncommon to own less than optimal real estate investment property without thinking about getting a perfect one.

An example is an individual inheriting a property; their first thought might be to rent it out or perhaps cash in on it, whereas their real estate investment portfolio could benefit from a 1031 exchange.

You also have to consider the two out of 5-year rule, which states that you could eliminate gains for the sale of your property up to $250,000 if you previously resided in the home for at least two years in the last five.

The time you spend in the home also doesn’t have to be concurrent. Most people in this situation do not consider a 1031 exchange.