|

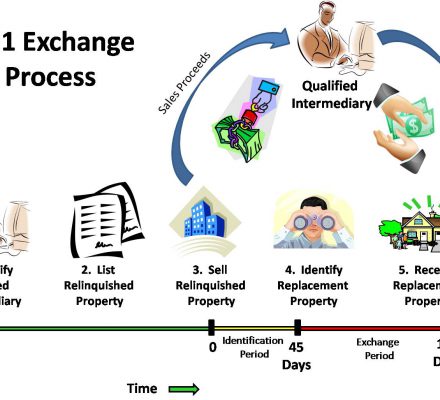

Once your 1031 exchange is in motion, it is important to track its progress through the system. Why? Time limits. Remember that your 1031 tax exchange is subject to strict, governmentally regulated time limitations – and you absolutely will not receive any extensions or second chances. For this reason, it is important to regularly check on the progress of your 1031 exchange. Until the forms are signed and you actually submit your tax documents to the IRS in April, your 1031 is not complete. Most sellers will complete a 1031 exchange with the assistance of a real estate, legal, and/or tax professional. No matter what individual or service is assisting with your 1031 exchange, make it your business to check on the status of the transactions regularly. Ensure that your replacement property has been legally declared (in writing) within the 45-day limit and that the entire procedure takes place within the 180-day limit (or sooner if tax time so demands). Once you’ve begun a 1031 transaction, it is your responsibility to make sure that it reaches completion.

1031 Tax Exchange – What Happens When I Sell My Replacement Property? I’ve completed my first 1031 tax exchange. What happens when I sell my replacement property? First, it is important to remember that there are federally mandated limits for the amount of time you must hold your replacement property before you may sell it in any transaction (though there are available loopholes for those willing to go out of their way). Once you’ve reached that amount of time, however, you can use that replacement property as the relinquished property in another 1031 exchange. This allows you to effectively climb the “property ladder†and move from one property to another and then to another, gaining value all the time. It is critical, however, to remember that a 1031 is a tax deferment – not tax forgiveness. You will still owe taxes on your capital gains earned through investment and business real estate. Think about it in terms of your traditional IRA or employer-sponsored 401(k). Right now, you’re saving that money without paying any taxes. The savings go in and the savings grow – but you don’t pay capital gains tax on that money until you reach retirement and actually begin to cash out the account and use the money. A tax-deferred 1031 real estate exchange works much the same way. As long as you continue to re-invest your money in other real estate, the capital gains taxes will be put off for sometime in the vague future. You may pay taxes on any rental income that you take in – but not on the appreciation of the real estate itself. When you’re ready to sell your last piece of property and exit from the real estate business, however, that deferred capital gains tax is going to come into play and rear its (possibly quite ugly) head. In this case, many sellers choose to use a structured sale. This allows many benefits to you as the seller and helps lessen the blow of that accumulated capital gains tax, allowing you to exit the real estate market gracefully. |