While the goal of a 1031 exchange is most certainly to save you money, the process is a legal transaction that does require the assistance of trained professionals and, thus, a number of fees.

Generally, the administrative costs of setting up and closing on your relinquished property fall in the neighborhood of $300 per occurrence. For the replacement property (the property being purchased), the administrative costs are likely to be in the neighborhood of $150 – for a total cost of $450 for a full transaction in which one property is sold and another property is bought.

As a general rule, however, the fees associated with a 1031 tax exchange are minimal compared to what might be lost immediately in taxes – and working with a professional guarantees that the transaction will be completed effectively, appropriately, and, most importantly, legally. All the fees in the world, however, cannot protect you from the stringent timelines that are in place for 1031 exchanges.

1031 Tax Exchange Time Limits

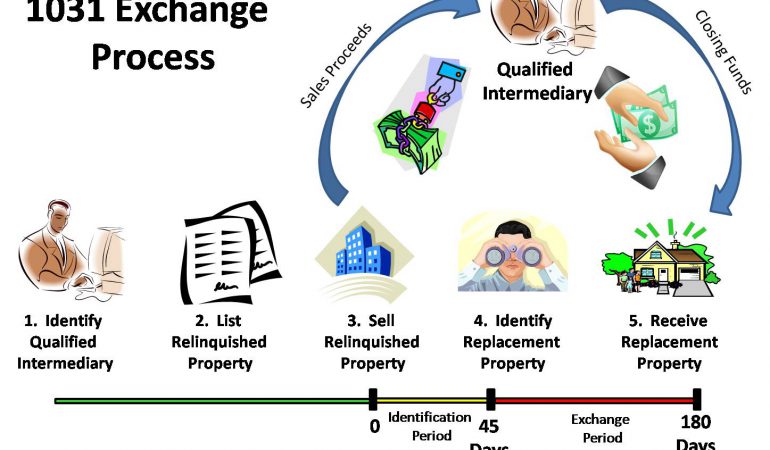

A 1031 tax exchange begins when you sell a property. The clock officially starts ticking on either the date the deed of sale is recorded or the date that possession is transferred to the buyer – whichever comes first. The legal period for the 1031 tax exchange then ends either 180 days after it begins or on the date that the exchanger’s (read: your) tax return is due (including any tax deadline extensions) for the tax year in which the relinquished property is transferred – again, whichever comes first. These deadlines are hard and fast: don’t expect to receive an extension, as there are no allowable reasons for an extension. This holds true even when a deadline falls on Thanksgiving, Christmas, or New Year’s Day: you will not be given an extra business day by the U.S. government.

The first 45 days of the 180-day (or less) period is called the identification period and is subject to its own set of rules. During this 45-day period, you must identify and declare your intended replacement property. This 45-day period is, again, enforced strictly and is not subject to hard-luck stories. If your identified replacement property is destroyed by a natural disaster after the 45-day period ends . . . you are not entitled to identify a new property. If you discover a different and better replacement property after the 45-day period ends . . . you are not entitled to identify a new property.

Additionally, there are no special exceptions made for sellers who are relinquishing multiple properties at once. In this instance, all deadlines begin on the transfer date of the first property and, not surprisingly, may not be extended.