1031 Escrow Companies, Real Estate Agents, and Exchangers

Because of the complicated nature of 1031 exchanges, it is important to work with the guidance of a trained, certified professional in the field who can help you navigate the ins and outs of the process. This means working with an 1031 tax exchange escrow company, real estate agent, lawyer, or exchange specialist. Find a company or individual that makes you feel comfortable: the process of a 1031 exchange is relatively long, and you’ll be relying on this person or entity for an extended period of time. Having the right assistance, then, is critical – so take the time to really consider your options.

1031 Exchange – Replacement Property

Can I identify more than one replacement property for my 1031 exchange?

As a general rule, the idea behind a 1031 exchange is to help real estate investors “upgrade†to a larger or better property as they progress in the business. This means that most 1031 exchangers will be looking for replacement properties that are of a higher value than the property they are selling (or at least a property that is in line with the appreciated value of the current property).

In some situations, however, you might find yourself looking to replace an investment property with a number of smaller properties rather than one larger property. Depending on the market in your specific area, this can be a smart decision for financial reasons.

Exchangers are allowed to identify multiple replacement properties for one 1031 tax exchange transaction if they adhere to one of two stipulations. The first scenario is known as the three-property rule. It simply states that you may identify a maximum of three eligible replacement properties. In this situation, the fair market value of the replacement properties does not matter: as long as there are no more than three, the 1031 exchange may proceed.

The second option is the 200 percent rule. In this scenario, an exchanger is allowed to identify any number of properties – but the total fair market value of the combined properties must be less than 200 percent of the total fair market value of all relinquished properties.

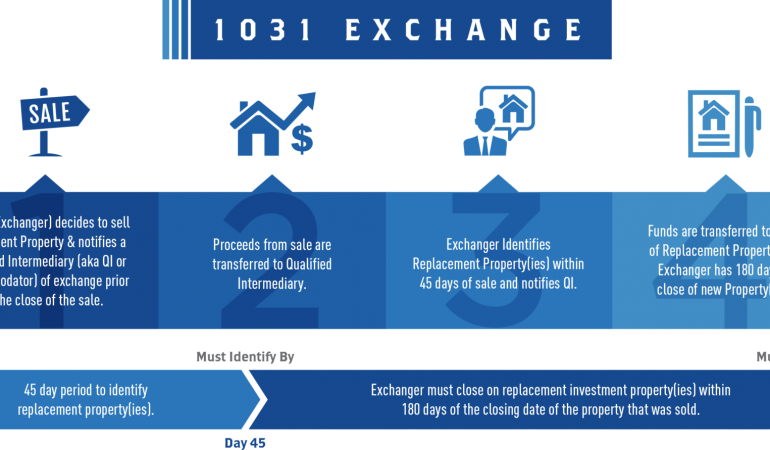

An interesting caveat to these rules is that fair market value for replacement values is not figured until the end of the identification period (45 days). The fair market value of your relinquished property (or properties), however, is set as of the date of transfer. If at the end of your identification period your total for replacement properties is too high, your 1031 tax exchange will not go through: the IRS will treat you as though you have identified no replacement property.