Every long-term property investor aims to generate passive income, starting with cash flow. Comprehending how you can generate cash flow can help you pick the top rental units while gaining access to unseen prospects that other real estate investors might miss.

This article aims to explain what cash flow is, how it can be calculated, my cash flow is good, and some ways to create the highest amount of cash flow opportunities in real estate.

Definition of Cash Flow

Rental properties can generate two forms of cash flow: net cash flow and gross cash flow.

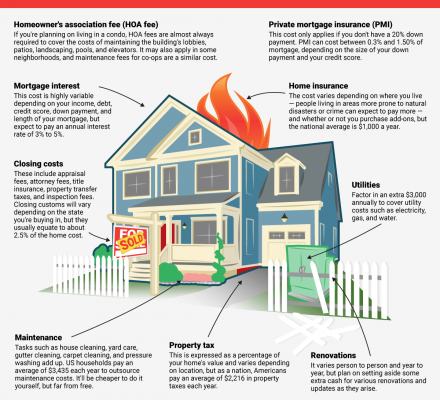

Net cash flow can be defined as the money remaining at the end of every month once rent is collated and all the expenses or bills are sorted. Gross cash flow can be defined as money collected from rent and additional services like late fees, appliance renting, and application fees.

When it comes to net cash flow generated from rental real estate, it should always be positive. Nevertheless, cash flow can be negative should expenses exceed the property’s generated income. A property can have negative cash flow for various reasons, including using excessive leverage when financing, overpaying for rental real estate or having an extended vacancy.

Calculating Cash Flow

Cash flow generated from a rental property can be calculated in three steps:

- First, calculate the gross cash flow by combining older and every other income generated

- Deduct all contributions to capital expense accounts and all operating expenses

- Subtract the mortgage payment if the property was financed

The balance left is your cash flow first up. You should understand that cash flow is not always the exact amount you get from one month or another or even one year to another.

For instance, you can minimize leasing fees by maintaining low tenant turnover. You could cut down money spent on maintenance and repairs by conducting seasonal preventative measures such as servicing furnaces or HVAC systems to help eliminate significant unforeseen expenses.

How Much Cash Flow Is Good for Rental Property?

The simplest way to answer this question is to say that just about any positive cash flow figure is good for rental property. As a rule of thumb, the larger the amount, the better it is. Nevertheless, good cash flow can be subjective and typically varies from one real estate investor to another.

Certain real estate investors search for the lowest possible return on investment, while others search for properties that can generate a certain amount of cash flow to meet targets.

Cash on Cash

Cash on cash is another way to determine how much cash flow is good. It is done by determining the cash on cash return of your property. This requires you to compare the net profit to the capital originally put into the property:

Cash on cash: Net flow / Capital invested

If you put a $30,000 down payment on a building that creates a net cash flow of $4,000 annually (this is after sorting all the associated bills), you can expect your cash on cash return to be:

$4,000 Net cash flow / $30,000 down payment cash = 0.133 or 13.3%

Cash on cash return can be a great calculation when investing in value-added rental property. For instance, if you are buying an investment property that requires $6,000 in extra repairs and upgrades. Once the improvements have been made, your net cash flow—as a result of an increase in gross rents thanks to the improvements—becomes $7,000, then the updated cash on cash return will be:

$7,000 Net cash flow / $36,000 cash invested (original $30,000 down payment plus $6,000 in additional repairs and upgrades) = 0.194 or 19.4%.

A great cash on cash return will vary depending on the real estate investor. A general rule of thumb to remember is that quite a number of cash flow real estate investors target a return of at least 10% when they invest.

Return on Investment

Return on investment or ROI is a metric that indicates just how profitable an investment capital is. This metric is calculated by comparing your net profit to the total cost of said property:

ROI = net cash flow / property cost.

So, for instance, if the yellow cash flow is $20,000 and the property costs $100,000, then ROI can be calculated as .20 or 20% ROI.

Generally, most real estate investors search for an ROI of at least 8%. Nevertheless, depending on the type of investment strategy, certain real estate investors are perfectly fine with a 6% return. Others who concentrate on income-generating properties prefer a return on investments of at least 12%.

Ways to Increase Cash Flow

Intelligent property investors always search for ways to increase net and gross cash flow. And while it might not appear to be a lot, simply increasing monthly cash flow by $20 can raise the value of your property, which raises yields by thousands of dollars in the long run.

A few of the largest factors to consider when trying to increase your rental property cash flow are:

- Performing seasonal maintenance on integral items like cooling, plumbing, and heating systems

- Employing a professional property manager, especially one who knows your market and has a network of cost-effective suppliers and handymen

- Strategically adding improvements that tenants value and are willing to pay for in the form of higher rent. This can be updated finishes of energy-efficient appliances

- Screening tenants and conducting background checks to ensure only the most qualified tenants are housed

- Taking measures to keep tenant turnover low

Calculating Gross Cash Flow by Utilizing the 1% Rule

The 1% Rule is an easy and quick way to “guesstimate” what a property’s gross rent should be. The rule states that the gross monthly rent you get from a property should equal at least 1% of the property’s buy price.

This means:

Property price = $200,000 x 1% = $2000 monthly gross rent

The more monthly rental income you can generate compared to the property’s price, the higher your prospective return could be. You can use the 1% Rule to filter out properties that do not generate sufficient cash flow while identifying those that indeed do.

For instance, if you are searching for a rental unit with a market value of $100,000 and you want a monthly rent of $900, you can use the 1% Rule to determine if your prospective rental income is 1% of the buy price:

Gross monthly rent / Property price = n%

$900 Gross monthly rent / $100,000 property = 0.009 or .9%

Using the 1% Rule with the above calculation, we can determine that the property’s gross rent compared to its buy price is 0.9%, less than the required 1%. Nevertheless, before filtering this property from the shortlist of prospective acquisitions, it is important to bear in mind that there are various reasons why your gross rent is less than 1%. They are:

- It could be that the property has deferred maintenance, a feature that could increase the value of the property and raise the rent once upgrades and repairs have been completed.

- Rent is priced below market, which provides the chance to increase cash if rent is raised to match market rent.

- The building is overpriced, located in a seller’s market with relatively higher prices or in a fast-appreciating market where property prices are appreciating quicker than rents.

For short-term real estate investors, purchasing properties in quickly appreciating markets can make sense; however, there is a risk that the prices can stop appreciating. Buy and hold real estate investors (LINK TO buy and hold article) can benefit from below-market rents as they provide a massive opportunity to create healthy profits in the long term.

Conclusion

Cash flow can be described as the lifeblood of any real estate property investor. Thankfully, calculating cash flow doesn’t require extremely complex financial formulas; it can be done in 3 basic steps.

Finding a rental property with decent cash flow in various realty markets isn’t a walk in the park. However, if you find one, you can be assured that your rental property is creating a sufficient amount of cash flow to not only pay for itself but also help you develop passive income, which you can use to create long-term wealth.

You should note that gross cash flow is also known by another term, gross yield. It can be quite easy to locate an income-generating property with a high yield, aka high cash flow, on the InvestInMultiHome site.

You can join the Investor Club, where there are a plethora of properties to select from, ranging from small multifamily properties to vacation rentals and single-family units.