Have you ever wished there was a way to legally hack the tax system and keep more money in your pocket? Well, look no further than 1031 exchanges.

These bad boys are the ultimate tax hack, allowing you to defer capital gains taxes when selling and reinvesting in similar properties.

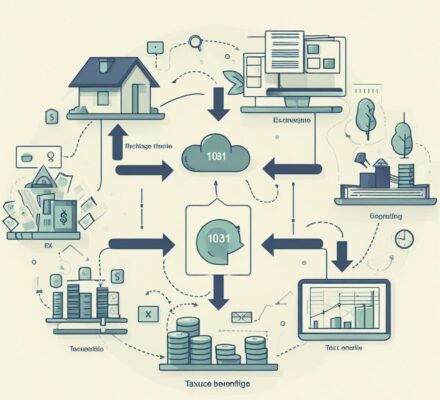

In this article, we’ll dive into the basics of 1031 exchanges, show you how they can save you money, and provide a step-by-step guide to completing one successfully.

Get ready to level up your tax game!

Key Takeaways

- 1031 exchanges allow you to defer capital gains taxes on the sale of certain properties.

- By reinvesting the proceeds into similar properties, you can potentially grow your investment further.

- Utilizing a 1031 exchange allows you to roll over your investment into a new property without immediate tax liabilities.

- 1031 exchanges provide opportunities for estate planning to pass on real estate holdings without incurring significant tax burdens.

The Basics of 1031 Exchanges

If you frequently find yourself looking for ways to minimize your tax burden, you’ll want to understand the basics of 1031 exchanges. This tax strategy allows you to defer capital gains taxes on the sale of certain types of property by reinvesting the proceeds into a similar property. In essence, it’s like a real estate swap that allows you to defer taxes until you sell the replacement property.

To qualify for a 1031 exchange, both the property you’re selling (relinquished property) and the property you’re buying (replacement property) must meet certain criteria. The most important requirement is that both properties are held for investment or used in a trade or business. Personal residences don’t qualify for 1031 exchanges.

Another key factor to consider is the strict timeline involved in a 1031 exchange. From the date of the sale of the relinquished property, you have 45 days to identify potential replacement properties and 180 days to complete the purchase. These time limits are non-negotiable, so planning and coordination are crucial.

How 1031 Exchanges Can Save You Money

To save money, take advantage of 1031 exchanges and defer capital gains taxes by reinvesting the proceeds from the sale of qualifying properties into similar ones. This powerful tax strategy allows you to keep more of your hard-earned money by deferring the payment of capital gains taxes until a later date. By utilizing a 1031 exchange, you can effectively roll over your investment into a new property without incurring immediate tax liabilities.

One of the key benefits of a 1031 exchange is the ability to defer capital gains taxes, which can significantly reduce your tax burden. Let’s take a closer look at how this works:

| Property A | Property B | Capital Gains |

|---|---|---|

| $500,000 | $800,000 | $300,000 |

In this example, if you were to sell Property A without a 1031 exchange, you would owe taxes on the $300,000 capital gains. However, by reinvesting the proceeds into Property B through a 1031 exchange, you can defer the payment of taxes and potentially grow your investment further.

Key Benefits of Utilizing a 1031 Exchange

Discover the key benefits of utilizing a 1031 exchange to maximize your tax savings and investment potential.

A 1031 exchange allows you to defer paying capital gains taxes when you sell an investment property and reinvest the proceeds into another like-kind property. By deferring these taxes, you can preserve your investment capital and use it to acquire a higher-value property.

One significant benefit of a 1031 exchange is the ability to diversify your real estate portfolio. You can exchange a single property for multiple properties, allowing you to spread your investment across different locations and property types. This diversification can reduce risk and increase your chances of generating a steady income stream.

Another advantage is the potential for increased cash flow. By exchanging into a property with a higher rental income potential, you can boost your monthly cash flow and increase your overall return on investment. This extra income can be used to reinvest in additional properties or cover expenses.

Additionally, a 1031 exchange provides the opportunity for estate planning. When you pass away, your heirs will receive a stepped-up basis on the property, eliminating any capital gains tax liability. This can be a valuable strategy to pass on your real estate holdings to future generations without incurring a significant tax burden.

Step-by-Step Guide to Completing a 1031 Exchange

To complete a 1031 exchange, you’ll need to follow these step-by-step instructions:

- Identify the replacement property: Start by identifying potential replacement properties within 45 days of selling your current property. This is a crucial step as it sets the foundation for a successful exchange. Take your time to research and find properties that align with your investment goals.

- Engage a qualified intermediary: To comply with IRS regulations, you must work with a qualified intermediary (QI). The QI will facilitate the exchange process, hold the funds, and ensure all necessary paperwork is completed correctly. Choose a reputable QI with experience in 1031 exchanges to ensure a smooth transaction.

- Complete the exchange within 180 days: Once you’ve identified the replacement property, you have 180 days from the sale of your original property to complete the exchange. This includes closing on the new property and transferring the funds held by the QI. It’s crucial to stay organized and meet all deadlines to avoid any potential tax consequences.

Following these step-by-step instructions will help you navigate the complex process of completing a 1031 exchange. Remember to consult with a tax professional or attorney to ensure compliance with all IRS regulations. Happy exchanging!

Common Mistakes to Avoid When Doing a 1031 Exchange

Avoid these three common mistakes when doing a 1031 exchange to ensure a successful tax hack.

Firstly, one common mistake to avoid is missing the strict deadlines. The 1031 exchange has strict time frames that must be followed. You have 45 days from the sale of your original property to identify potential replacement properties. Then, you must close on one or more of those identified properties within 180 days. Failing to meet these deadlines can result in disqualification from the tax benefits of a 1031 exchange.

Secondly, make sure to properly identify replacement properties. The IRS requires you to identify potential replacement properties within the 45-day window. You can identify up to three properties, regardless of their value, or identify more properties as long as their combined value doesn’t exceed 200% of the value of the original property. Failure to accurately identify replacement properties can lead to disqualification.

Lastly, avoid receiving any cash or other non-like-kind property during the exchange process. The purpose of a 1031 exchange is to defer taxes by exchanging one property for another of like-kind. Receiving cash or other non-like-kind property can trigger a taxable event. It’s essential to ensure that the exchange is done solely with like-kind properties.

Frequently Asked Questions

What Are the Potential Risks or Downsides of Utilizing a 1031 Exchange?

When using a 1031 exchange, there are potential risks and downsides to consider. These include strict time constraints, limited property options, and the possibility of paying capital gains tax if the exchange is not completed successfully.

Are There Any Time Limitations or Deadlines That Need to Be Met When Completing a 1031 Exchange?

To complete a 1031 exchange, you must meet certain time limitations and deadlines. These requirements ensure that you identify replacement properties within 45 days and close on the exchange within 180 days.

Can a 1031 Exchange Be Used for Personal Property or Only for Real Estate?

Can you use a 1031 exchange for personal property or just real estate? A 1031 exchange is specifically designed for real estate, not personal property. It allows you to defer taxes by exchanging one property for another.

Are There Any Restrictions on the Types of Properties That Can Be Exchanged in a 1031 Exchange?

There are restrictions on the types of properties that can be exchanged in a 1031 exchange. The property must be held for investment or business purposes, and certain types of personal property are excluded.

Can a 1031 Exchange Be Used to Defer Taxes Indefinitely, or Are There Limitations on How Many Times It Can Be Used?

You can use a 1031 exchange to defer taxes multiple times, but there are limitations. It’s not an indefinite tax hack, but it can be a valuable tool for deferring taxes on real estate investments.