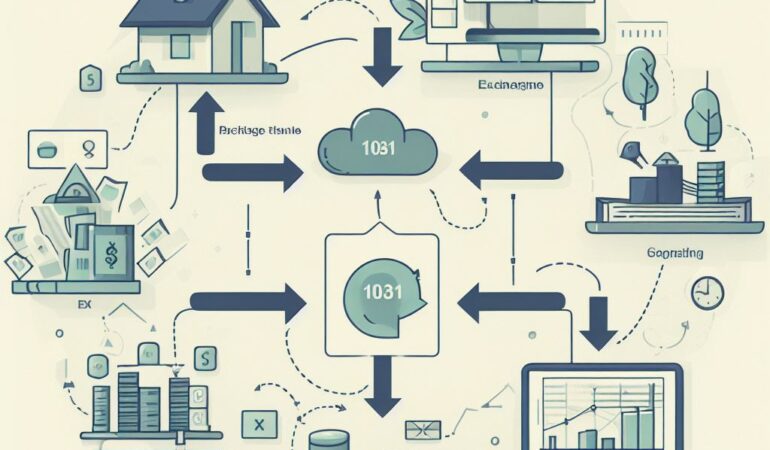

Imagine maximizing your tax benefits by utilizing the powerful strategy of a 1031 exchange. This step-by-step guide will walk you through the process, providing the necessary insights and tools to optimize your financial gains.

From understanding the basics of the exchange to identifying the right replacement property, you’ll gain a comprehensive understanding of how to complete the exchange and enjoy the advantages it offers.

Let’s dive into the world of tax optimization with the 1031 exchange.

Key Takeaways

- A 1031 exchange allows for the deferral of capital gains tax on the sale of an investment property.

- The exchange involves reinvesting the proceeds from the sale into a replacement property, allowing for continued growth of a real estate portfolio without immediate tax liability.

- Eligible properties for a 1031 exchange include rental properties, commercial buildings, vacant land, and industrial facilities.

- It is important to work with a qualified intermediary who has experience and expertise in handling 1031 exchanges, and who can ensure compliance with IRS regulations.

Understanding the 1031 Exchange

To fully optimize tax benefits with a 1031 exchange, you need to understand how the exchange works. A 1031 exchange, also known as a like-kind exchange, allows you to defer capital gains tax on the sale of an investment property by reinvesting the proceeds into another property of equal or greater value. This powerful tax strategy is governed by Section 1031 of the Internal Revenue Code.

The key concept behind a 1031 exchange is that the transaction is treated as an exchange, not a sale. This means that you can defer the capital gains tax that would normally be due upon the sale of your property. Instead of recognizing the gain, you can use the proceeds to acquire a replacement property. By doing so, you can continue to grow your real estate portfolio without triggering an immediate tax liability.

To qualify for a 1031 exchange, both the relinquished property (the property being sold) and the replacement property must meet certain eligibility and qualification criteria. Understanding these criteria is essential for a successful exchange. So, let’s dive deeper into the eligibility and qualification requirements in the next section.

Eligibility and Qualifications

To determine whether you’re eligible for a 1031 exchange and if your properties meet the necessary qualifications, you need to consider specific criteria. Here are four key factors to assess:

- Property Type: The property you’re relinquishing and the one you’re acquiring must both be held for investment or business purposes. This means that personal residences or properties primarily used for personal purposes don’t qualify. Examples of eligible properties include rental properties, commercial buildings, vacant land, and industrial facilities.

- Like-Kind Requirement: The properties involved in the exchange must be of like-kind, which means they’re of the same nature or character. This allows for a broad range of properties to qualify, such as exchanging a residential rental property for a commercial office building.

- Timing: The 1031 exchange process has strict timelines that must be followed. You have 45 days from the date of selling your property to identify potential replacement properties. Additionally, you must close on the replacement property within 180 days from the sale of your original property.

- Qualified Intermediary: To ensure compliance with IRS regulations, a qualified intermediary must be used to facilitate the exchange. This third-party intermediary holds the funds from the sale of your property and facilitates the purchase of the replacement property.

Finding a Qualified Intermediary

After assessing the eligibility and qualifications for a 1031 exchange, it’s important to find a qualified intermediary to ensure compliance with IRS regulations. A qualified intermediary (QI) is a third-party entity that facilitates the exchange process by holding the funds from the sale of the relinquished property and then using them to purchase the replacement property. The QI plays a crucial role in ensuring that the transaction meets all the requirements outlined by the IRS.

When searching for a qualified intermediary, it’s essential to consider their experience and expertise in handling 1031 exchanges. Look for a QI who’s a solid understanding of the tax code and is well-versed in the intricacies of the exchange process. They should also have a proven track record of successfully completing 1031 exchanges.

Additionally, it’s crucial to choose a QI who’s financially stable and has the necessary resources to handle the funds involved in the exchange. The QI should have proper safeguards in place to protect the funds throughout the process.

Identifying and Acquiring Replacement Property

Once you have found a qualified intermediary, the next step in the 1031 exchange process is to identify and acquire replacement property. This is a crucial step in maximizing your tax benefits. Here is a step-by-step guide to help you navigate this process:

- Determine your investment criteria: Clearly define what you’re looking for in a replacement property. Consider factors such as location, size, property type, and potential for growth.

- Conduct thorough research: Utilize online resources, real estate agents, and market reports to identify potential replacement properties that meet your criteria. Evaluate their financial viability and potential for long-term growth.

- Visit and inspect potential properties: Once you have narrowed down your options, visit the properties in person. Conduct a detailed inspection to ensure they meet your standards and align with your investment goals.

- Make an offer and negotiate: Once you have identified the ideal replacement property, make an offer and negotiate the terms of the purchase. Work closely with your real estate agent and attorney to ensure a smooth transaction.

By following these steps, you can confidently identify and acquire replacement property that aligns with your investment goals and maximizes your tax benefits.

Once this process is complete, you can move on to the next phase of completing the exchange and enjoying the tax benefits.

Completing the Exchange and Enjoying the Tax Benefits

To complete the exchange and enjoy the tax benefits, you’ll need to follow a few important steps.

First, once you have identified the replacement property that meets the like-kind requirement, you’ll need to enter into a purchase agreement with the seller. It’s crucial to include language in the contract that clearly states your intent to complete a 1031 exchange and allows for the assignment of your rights to a qualified intermediary.

Next, you must notify your qualified intermediary of the impending sale of your relinquished property and provide them with the necessary documentation. This includes a copy of the purchase agreement, the settlement statement, and any other relevant documents. The intermediary will then prepare the necessary exchange documents and hold the funds from the sale in a segregated account.

Once the relinquished property is sold, the intermediary will use the proceeds to acquire the replacement property on your behalf. It’s important to adhere to the strict timeline set forth by the IRS, which requires you to identify potential replacement properties within 45 days and complete the exchange within 180 days.

Once the replacement property is acquired, you can enjoy the tax benefits of the 1031 exchange. By deferring the capital gains tax, you can reinvest the full amount of the proceeds into a new property, allowing for potential growth and increased wealth. It’s essential to consult with a tax professional to ensure compliance with all IRS regulations and maximize the benefits of the 1031 exchange.

Frequently Asked Questions

Can I Use a 1031 Exchange to Defer Taxes on the Sale of a Primary Residence?

Yes, you can use a 1031 exchange to defer taxes on the sale of a primary residence. It allows you to reinvest the proceeds into another property of equal or greater value, deferring the capital gains tax.

Are There Any Time Restrictions for Completing a 1031 Exchange?

Yes, there are time restrictions for completing a 1031 exchange. You have 45 days to identify a replacement property and 180 days to close on the purchase, both starting from the date of the sale.

Can I Use a 1031 Exchange to Acquire Multiple Replacement Properties?

Yes, you can use a 1031 exchange to acquire multiple replacement properties. This allows you to diversify your real estate holdings and potentially increase your tax benefits.

What Happens if I Can’t Find a Suitable Replacement Property Within the Designated Timeframe?

If you can’t find a suitable replacement property within the designated timeframe, you may have to pay capital gains tax on the sale of your property. Consult with a tax professional for guidance.

Can I Use a 1031 Exchange to Defer Taxes on the Sale of a Property That I Inherited?

Certainly! You can indeed utilize a 1031 exchange to defer taxes on an inherited property’s sale. By following the step-by-step guide, you can optimize tax benefits and navigate the process smoothly.