Looking to optimize your 1031 exchange tax benefits? Well, guess what? You’re in luck! In this article, we’ve got the top 5 ways to make the most out of your exchange.

From understanding the process to choosing the right replacement property, we’ve got you covered.

So, if you want to save on taxes and maximize your gains, keep reading. It’s time to take control of your financial future.

Key Takeaways

- Identify replacement property within 45 days of selling current property

- Consider location in growing markets with strong economic indicators

- Use a qualified intermediary to handle the exchange

- Stay updated on tax regulations and changes

Understand the 1031 Exchange Process

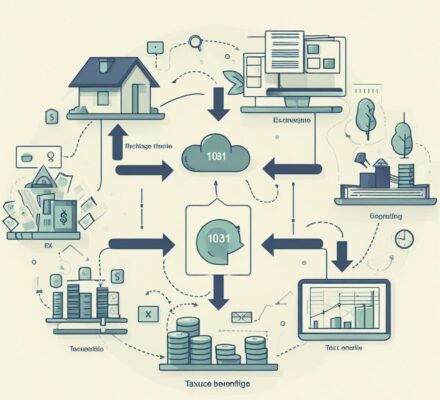

To optimize your 1031 exchange tax benefits, start by understanding the process of the 1031 exchange. This process allows you to defer capital gains tax on the sale of your property by exchanging it for a like-kind property.

The first step is to identify a replacement property within 45 days of selling your current property. This identification must be in writing and include a description of the property.

Next, you have 180 days from the sale of your property to complete the exchange by acquiring the replacement property. It’s important to note that the replacement property must have a value equal to or greater than the property being sold.

Additionally, you must use a qualified intermediary to handle the exchange and hold the funds during the process. This intermediary will ensure that the exchange is conducted in accordance with IRS regulations.

Choose the Right Replacement Property

Now that you understand the 1031 exchange process, it’s time to move on to the next step: choosing the right replacement property. This is a crucial decision that can greatly impact your tax benefits and overall investment success. To help you make an informed choice, consider the following factors when selecting your replacement property:

| Factor | Consideration |

|---|---|

| Location | Look for properties in growing markets with strong economic indicators. Consider factors such as job growth, population trends, and potential for future development. |

| Cash Flow | Evaluate the potential rental income and expenses associated with the property. Ensure that the cash flow generated is sufficient to cover any mortgage payments, property taxes, and maintenance costs. |

| Appreciation Potential | Research the historical and projected appreciation rates in the area. Choose properties that have a track record of consistent appreciation or are located in areas with high growth potential. |

Taking the time to carefully analyze and compare potential replacement properties can maximize your tax benefits and long-term investment returns. Remember to consult with a qualified tax professional and real estate advisor to guide you through the process and ensure compliance with all IRS regulations. By choosing the right replacement property, you can optimize the tax benefits of your 1031 exchange and set yourself up for future financial success.

Timing Is Everything: Plan Your Exchanges Strategically

Plan your exchanges strategically to maximize the tax benefits of your 1031 exchange. Timing plays a crucial role in the success of your exchange, so it’s important to plan accordingly. Here are five key factors to consider when planning your exchanges:

- Market conditions: Keep an eye on the real estate market and identify favorable conditions that could lead to higher property values or increased rental income.

- Economic trends: Stay informed about economic trends that could affect your investment, such as interest rates, inflation, or changes in the tax code.

- Property availability: Research the availability of replacement properties in your desired location and ensure they meet your investment criteria.

- 45-day identification period: Understand the strict timeline of the 1031 exchange process, especially the 45-day identification period, during which you must identify potential replacement properties.

- 180-day exchange period: Familiarize yourself with the 180-day exchange period, which is the total time you have to complete the exchange after selling your relinquished property.

By strategically planning your exchanges, you can take advantage of favorable market conditions, make informed decisions, and maximize the tax benefits of your 1031 exchange.

Now, let’s explore the next step in optimizing your exchange: considering the use of a qualified intermediary.

Consider Using a Qualified Intermediary

When considering optimizing your 1031 exchange tax benefits, it’s essential to utilize the services of a qualified intermediary. A qualified intermediary, also known as a QI, is a crucial player in the 1031 exchange process. They act as a neutral third party who facilitates the exchange by holding the proceeds from the sale of your relinquished property and then using those funds to acquire the replacement property.

By using a qualified intermediary, you can ensure that your exchange meets the strict requirements set forth by the Internal Revenue Service (IRS). The IRS requires that the proceeds from the sale of your relinquished property be held by a third party and not be directly received by you. Failure to comply with this requirement could result in disqualification of the exchange, leading to significant tax consequences.

In addition to providing a secure and compliant exchange process, a qualified intermediary can also offer valuable guidance and expertise. They can help navigate the complex rules and regulations associated with 1031 exchanges, ensuring that you make informed decisions that maximize your tax benefits.

Choosing a qualified intermediary is an important decision. Look for a professional who’s experience in facilitating 1031 exchanges and who’s knowledgeable about the specific requirements in your state. Taking the time to find a reputable and reliable qualified intermediary can save you time, money, and potential headaches throughout the exchange process.

Stay Updated on Tax Regulations and Changes

To optimize your 1031 exchange tax benefits, it’s important for you to regularly stay updated on tax regulations and changes. This will ensure that you’re aware of any new rules or requirements that may affect your exchange. Here are five key reasons why staying updated on tax regulations is crucial:

- Avoid Penalties: By staying informed about tax regulations, you can prevent costly penalties for non-compliance or mistakes in your exchange.

- Maximize Savings: Understanding the latest tax laws can help you identify opportunities to maximize your tax savings and take advantage of any available deductions or credits.

- Plan Ahead: Being aware of upcoming changes allows you to plan your exchange strategically and make informed decisions that align with your financial goals.

- Stay Compliant: Tax regulations can change frequently, so staying updated ensures that you remain in compliance with the law and avoid any potential legal issues.

- Gain an Edge: Knowledge is power, and by staying informed on tax regulations, you can gain a competitive edge in the real estate market and make better-informed investment decisions.

Frequently Asked Questions

Can I Use the 1031 Exchange for Personal Property or Is It Only Applicable to Real Estate?

Yes, you can use a 1031 exchange for personal property. It is not limited to real estate. However, there are certain requirements and guidelines that must be followed to qualify for the tax benefits.

What Are the Key Considerations When Choosing a Replacement Property for a 1031 Exchange?

When choosing a replacement property for a 1031 exchange, you should consider factors like location, potential for appreciation, and rental demand. These considerations will help you maximize your tax benefits and make a wise investment decision.

How Long Do I Have to Identify and Acquire the Replacement Property in a 1031 Exchange?

You have 45 days from the sale of your property to identify potential replacement properties and 180 days to acquire one. It’s important to plan and act quickly to meet these deadlines.

Are There Any Restrictions on the Types of Properties That Qualify for a 1031 Exchange?

Yes, there are restrictions on the types of properties that qualify for a 1031 exchange. However, these restrictions can be navigated with the help of a qualified intermediary and proper planning.

What Are the Potential Tax Consequences if I Fail to Meet the Requirements of a 1031 Exchange?

If you fail to meet the requirements of a 1031 exchange, you could potentially face tax consequences. It’s important to follow the rules and guidelines to ensure you receive the desired tax benefits.