Real estate investing is one industry that has a reputation for creating wealth. Nevertheless, you should note that there are different ways to generate wealth via real estate. The profits linked with the real estate industry’s strategies also have various enticing tax benefits. For one, real estate can be used as a tax haven to store the income you accumulate.

Perhaps the most impressive tax benefit available to a real estate investor has to be the one that a buy and hold real estate investor enjoys: depreciation of investment property. Removing rental property depreciation from your taxable income is one of the best benefits of real estate investment opportunities.

What Is Rental Property Depreciation?

Real estate depreciation of an investment property can be defined as a substantial tax benefit that enables a rental property owner to subtract the costs of purchasing a particular property. This is similar to a typical business expense, as it enables real estate investors to subtract the cost of the home.

To this end, the Internal Revenue Service accounts for the real estate depreciation of investment property just as it would most office supplies. The US Government acknowledges that a buy and hold property investor typically relies on their properties to create rental income, thereby creating an avenue to reward them for what is the inevitable depreciation of their investment property.

That being said, houses are much more expensive than office supplies, which is why the building cost isn’t calculated in just one year. Depreciation of investment property tends to happen over the useful life of the property. The IRS determines this timeline at 27.5 years. Due to this, homeowners can write off a percentage of their home’s total purchase cost for almost 30 years.

You should note that most single-family houses tend to last beyond the 27.5-year limit. While the IRS is comfortable allowing property owners to write off a percentage of the total acquisition costs every year for 27.5 years, it isn’t uncommon for houses to remain in use for much longer. The largest depreciation tax benefit comes in at this point: the depreciation loss.

The depreciation deduction you make on your property over its 27.5 years of usable life are typically made in the face of inflation. History shows us that houses are more likely to see their value appreciate rather than depreciate. Often the loss never happens, which means that homeowners can leverage the depreciation deduction without the value of their assets actually depreciating.

What Properties Can Be Depreciated?

You should understand that not every property can qualify as a depreciating asset. For a home to be termed a depreciable asset, it needs to meet the requirements below:

- The determinable life of the property needs to exceed 1 year

- The property needs to have a determinable useful life

- The property needs to be used in an income-generating capacity or for a business

- The property needs to be owned by said taxpayer looking to subtract depreciation

A property might not be termed depreciable even though the abovementioned requirements are met. This happens when the property is placed in and eliminated from service within the same year. Nevertheless, the most effective way to know if the property qualifies is to enlist the services of a tax professional.

Discover how to build wealth with the buy and hold real estate strategy (LINK TO ARTICLE)

Depreciation of Investment Property: When Does It Begin?

Investment property depreciation typically begins when you place the homes in service. It could also be when the property is ready to be utilized as a rental.

For instance, if you purchase a rental unit on the 30th of May and have it ready for tenants on the 30th of August after working on it for various months. Your next step would be advertising the property in the local newspapers and online.

You then find a tenant with a lease that begins on the 1st of October. Since the property was placed in service—ready for leasing—on the 30th of August, you can begin depreciating the house in August rather than October when you begin collecting rent for said property.

You can continue the depreciation of investment property till you meet one of the conditions below:

- You choose to retire the property from active service, even if you haven’t fully recovered the total cost or cost basis. When the property is retired, it is no longer used as an income-generating property. It can also be retired if you convert it for personal use, exchange or sell it, if it is destroyed, or abandoned

- You choose to subtract the total cost of the property on another cost basis

Nevertheless, you can continue claiming the depreciation of investment property if it is not in use or is temporarily idle. For instance, If you conduct repairs after a tenant moves out, you could continue the depreciation of investment property while fixing up the depreciating asset for the next tenant.

Calculating Depreciation of Investment Property

When it comes to calculating the amount of depreciation of investment property, you can subtract yearly; there are three factors to consider:

- The method of depreciation

- The recovery period

- Your basis in the property

A residential rental property placed in service after 186 utilizes the Modified Accelerated Cost Recovery System (MACRS) to calculate depreciation. MACRS is an accounting method that spreads depreciation of investment property and costs over the 27.5 years that the IRS views as the useful life of the rental property.

It is suggested that you enlist the services of a qualified tax accountant to help you account for the depreciation of a residential rental property. Nevertheless, here are a few steps to bear in mind:

Discover the Basis of Your Property

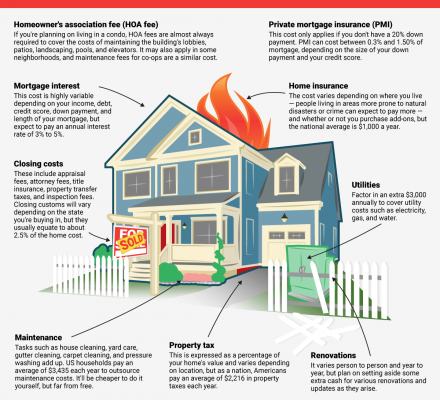

A property’s basis can be defined as the cost of the total amount you paid to purchase the property. This includes all the means you used to pay for the property: mortgage, cash, and more. You can also include settlement fees, closing costs, recording fees, legal fees, surveys, title insurance, transfer taxes, and any other fee that the seller owes you (back taxes) on the basis.

That being said, certain closing costs and settlement fees cant be added to your basis. You cannot add fees such as rent earned for the tenancy of the house before closing, fire insurance premiums, mortgage insurance premiums, appraisal fees, credit report costs, and fees associated with obtaining a loan or refinancing to the basis.

Separate Building and Land Costs

Since you are simply calculating the depreciation of investment property, you can only factor the building in your calculation. To define the value of the building, you can utilize the fair market value of both at the time you purchase the property. Alternatively, you can base your calculation on the evaluated real estate tax value.

For instance, should you purchase the house for $120,000 and the last real estate tax value states that the property is valued at $100,000, of which $9,000 is for the land, and $91,000 is for the house; this means that you allocate 10% of the buying price to the land, while 90% of the buying price goes to the house.

Determine the Basis In Your House

At this point, you should understand the basis of the property—defined as the house and the land—and the price of the house; it becomes easier to calculate your basis. When you use the example above as your basis—90% of the total price—you know how much you can depreciate.

Discover Your Adjusted Basis

It might be necessary to increase or decrease your basis to account for particular events between when you purchase the house and when the property is finally ready for rental.

An example of these increases to basis can include the cost of capital improvements or additions to the property that have at least a year of useful life before the property is placed in service.

Some other examples can be the amount of money used to repair damaged property, certain legal fees, and the cost of linking the property to utility services.

Basis decreases can be money received to grant an easement and insurance payments received due to theft, casualty loss, or damage not protected by insurance after you took a deduction.

With the above, you should clearly know how much it costs to purchase a home. This can help you determine the depreciation of investment property values.

Alternatively, you could use other methods to calculate depreciation. The GDS General Depreciation System or the ADS Alternative Depreciation System. While the General Depreciation System is typically used more often, it is still important to enlist the services of a tax professional to discover which system works best for you.

The type of system or depreciation method you select determines how much time you can depreciate your home. Using the GDS, you can depreciate your home annually for the required 27.5 years. Alternatively, with the ADS, property owners can depreciate a percentage of their basis for as much as 40 years.