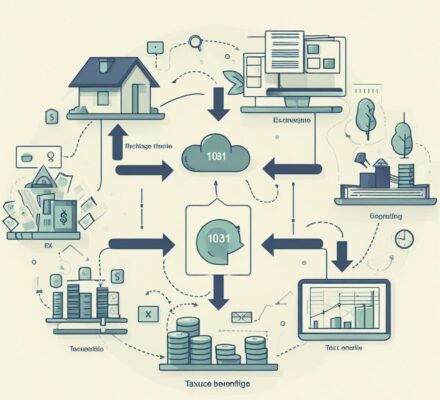

Are you tired of shelling out a significant chunk of your hard-earned profits in capital gains taxes when selling your real estate investments? Look no further! The 1031 exchange is here to save the day.

By utilizing this tax strategy, you can defer those pesky taxes and reinvest your earnings into new properties. With the opportunity for portfolio expansion, increased cash flow potential, and wealth accumulation through property appreciation, the 1031 exchange offers you the flexibility and benefits you’ve been searching for.

Key Takeaways

- Taxes on profit from the sale of investment property can be deferred through a 1031 exchange.

- Reinvesting money into like-kind property allows for the deferral of tax payment and provides more funds available for investment, leading to potential growth.

- The 1031 exchange allows investors to leverage their investment by reinvesting in multiple properties and diversify their real estate holdings, spreading risk.

- By deferring capital gains taxes through a 1031 exchange, investors can maximize their potential for growth and compounding returns, as well as increase their cash flow potential through higher rental rates or potential rental rate growth.

Deferral of Capital Gains Taxes

To maximize the tax benefits of a 1031 exchange, you can defer your capital gains taxes. This means that instead of paying taxes on the profit you make from the sale of your investment property, you can reinvest that money into another like-kind property and defer the payment of taxes until a later date. The deferral of capital gains taxes is one of the most attractive features of a 1031 exchange for real estate investors.

By deferring your capital gains taxes, you have the opportunity to keep more of your money working for you. Instead of paying taxes on the sale of your property, you can reinvest that money into a new property, potentially earning more income and building equity. This deferral allows you to have more funds available for investment, which can lead to greater returns and potential growth in your real estate portfolio.

Furthermore, deferring capital gains taxes through a 1031 exchange provides you with the ability to leverage your investment. By reinvesting the proceeds from the sale of one property into multiple properties, you can diversify your real estate holdings and spread your risk. This can help protect your investment and provide you with more opportunities for growth and success in the real estate market.

Opportunity for Portfolio Expansion

You can take advantage of the opportunity for portfolio expansion through a 1031 exchange by reinvesting your profits into new properties. This tax-deferred exchange allows you to sell a property and use the proceeds to acquire one or more replacement properties, without incurring immediate capital gains taxes. By leveraging the 1031 exchange, you can strategically grow your real estate portfolio and potentially increase your overall wealth.

One of the main benefits of using a 1031 exchange for portfolio expansion is the ability to defer taxes. Instead of paying capital gains taxes when you sell a property, you can reinvest the funds into new properties and defer the tax liability until a future date. This allows you to maximize the potential for growth and compounding returns.

Furthermore, the 1031 exchange provides flexibility in terms of property selection. You aren’t limited to acquiring properties that are similar to the one you sold. Instead, you can diversify your portfolio by investing in different types of properties, such as residential, commercial, or industrial. This diversification can help mitigate risk and enhance the long-term stability of your portfolio.

In addition, the 1031 exchange allows you to consolidate or exchange multiple properties into a single property, or vice versa. This flexibility enables you to optimize your portfolio by streamlining your holdings or acquiring properties that better align with your investment goals.

Increased Cash Flow Potential

By reinvesting your profits into new properties through a 1031 exchange, real estate investors can further enhance their portfolio and unlock the potential for increased cash flow. The 1031 exchange allows investors to defer capital gains taxes by exchanging one investment property for another of equal or greater value. This tax advantage enables investors to maximize their returns and generate additional income.

One of the key benefits of the 1031 exchange is the ability to acquire properties with higher rental income potential. By exchanging into properties that offer higher rental rates or have the potential for rental rate growth, investors can significantly increase their cash flow. This increased cash flow can provide investors with additional funds to reinvest or allocate towards other investments.

To illustrate the potential cash flow benefits of a 1031 exchange, consider the following example:

| Property A | Property B |

|---|---|

| Purchase Price | $500,000 |

| Annual Rental Income | $30,000 |

| Cash Flow (Annual Rental Income – Expenses) | $10,000 |

In this example, by exchanging Property A for Property B, which offers a higher rental income of $40,000 per year, the investor can increase their cash flow by $10,000 annually. This additional cash flow can provide a significant boost to the investor’s overall returns and financial position.

Wealth Accumulation Through Property Appreciation

One significant way real estate investors can accumulate wealth is through the appreciation of their properties. Property appreciation refers to the increase in value of a property over time, which can result from various factors such as market conditions, location, and improvements made to the property. As an investor, you can benefit from property appreciation in several ways.

Firstly, property appreciation allows you to build equity in your real estate investments. Equity is the difference between the property’s market value and the amount owed on any mortgages or loans. As the property appreciates in value, your equity increases, providing you with a greater net worth.

Secondly, property appreciation can generate significant wealth through capital gains. When you sell a property that has appreciated in value, you may realize a profit known as a capital gain. This profit is subject to capital gains tax, but there are strategies like the 1031 exchange that can defer this tax liability, allowing you to reinvest the proceeds into another property and continue accumulating wealth.

Lastly, property appreciation can also provide opportunities for leveraging. As the value of your property increases, you can use that increased equity to secure loans or lines of credit, which can be used for further real estate investments or other financial endeavors.

Flexibility in Investment Strategies

To maximize the benefits of property appreciation, real estate investors can take advantage of the flexibility offered by various investment strategies. These strategies allow investors to adapt their portfolios to changing market conditions, optimize returns, and mitigate risks.

One such strategy is diversification, which involves spreading investments across different types of properties, locations, and sectors. This approach helps mitigate the impact of market fluctuations and reduces the risk of significant losses in a single investment.

In addition to diversification, investors can also use different investment vehicles, such as real estate investment trusts (REITs) or real estate crowdfunding platforms, to gain exposure to a broader range of properties and markets. These options provide flexibility in terms of investment size and liquidity, allowing investors to enter or exit the market more easily.

Furthermore, real estate investors can leverage various financing strategies to enhance their returns. For example, they can use leverage to increase their purchasing power and acquire more properties. By borrowing funds to finance a property acquisition, investors can benefit from the potential appreciation of the property’s value while only investing a portion of their own capital.

Lastly, real estate investors can also utilize different hold and exit strategies to optimize their returns. They can choose to hold properties for the long term, benefiting from rental income and potential appreciation, or engage in shorter-term strategies, such as fix and flip or buy and hold for a specific period. Each strategy offers its own advantages and disadvantages, allowing investors to tailor their approach based on their goals and market conditions.

Frequently Asked Questions

How Long Do I Have to Identify and Acquire Replacement Properties in a 1031 Exchange?

You have 45 days from the date of the sale of your property to identify potential replacement properties in a 1031 exchange. You then have 180 days to acquire one or more of these identified properties.

Can I Exchange a Residential Property for a Commercial Property in a 1031 Exchange?

Yes, you can exchange a residential property for a commercial property in a 1031 exchange. This allows you to defer capital gains taxes and potentially increase your investment income.

Are There Any Limitations on the Number of Times I Can Utilize a 1031 Exchange?

You can utilize a 1031 exchange multiple times, but there are limitations. The number of exchanges you can do is not infinite. Consult with a tax professional to understand the specific rules and restrictions.

Is It Possible to Partially Exchange a Property in a 1031 Exchange?

Yes, you can partially exchange a property in a 1031 exchange. This allows you to defer taxes on the portion of the property that is exchanged, while receiving cash or other property for the remaining portion.

Are There Any Specific Requirements Regarding the Location of Replacement Properties in a 1031 Exchange?

Yes, there are specific requirements regarding the location of replacement properties in a 1031 exchange. The IRS states that the properties must be “like-kind” and within the United States.