You want to make the most out of your 1031 exchanges, don’t you? Well, let me tell you, proper tax basis determination is absolutely crucial. It’s the key to maximizing your tax-deferred benefits and avoiding any potential tax pitfalls.

So, you better buckle up and get ready to dive into this article because we’re about to show you the ins and outs of calculating tax basis in 1031 exchanges. Trust me, you don’t want to miss this.

Key Takeaways

- Accurate tax basis is crucial for successful 1031 exchanges.

- Strategically plan property acquisitions and dispositions to maximize tax-deferred benefits.

- Carefully consider tax basis determination to avoid potential tax pitfalls.

- Thoroughly review financial records and consult with a qualified tax professional to accurately calculate tax basis.

The Importance of Accurate Tax Basis

Accurately determining your tax basis is crucial for successful 1031 exchanges. In order to understand the importance of accurate tax basis, it’s essential to grasp the concept of tax basis itself. Tax basis refers to the original value of an asset for tax purposes.

When engaging in a 1031 exchange, the tax basis of the relinquished property becomes the tax basis of the replacement property. This means that any gains or losses are calculated based on the tax basis of the relinquished property. Therefore, an accurate tax basis is vital to ensure that the correct amount of gain or loss is reported on your taxes.

Failing to determine your tax basis correctly can result in unintended tax consequences. Underestimating the tax basis can lead to higher taxes paid on the gain from the sale of the replacement property. On the other hand, overestimating the tax basis can result in underreporting the gain and potentially triggering an audit by the IRS. Additionally, accurately determining your tax basis allows you to accurately calculate depreciation deductions, which can have a significant impact on your tax liability.

To accurately determine your tax basis, you must consider various factors such as the original purchase price, improvements made to the property, depreciation taken, and any additional costs incurred during the ownership period. Consulting a tax professional or utilizing specialized tax software can help ensure the accuracy of your tax basis calculations.

Maximizing Tax-Deferred Benefits

To maximize your tax-deferred benefits in a 1031 exchange, it’s crucial to strategically plan your property acquisitions and dispositions. By carefully considering the timing and types of properties involved, you can optimize the tax advantages offered by this exchange. One key strategy is to identify replacement properties with higher growth potential or income-generating capabilities than the relinquished property. This way, you can potentially increase your long-term wealth while deferring taxes on your gains.

Another approach to maximize your tax-deferred benefits is to diversify your real estate portfolio. By acquiring properties in different locations or sectors, you can spread your risk and potentially enhance your overall returns. Additionally, you may consider using a reverse 1031 exchange, which allows you to acquire your replacement property before selling your relinquished property. This can be advantageous in a competitive market where finding suitable replacement properties can be challenging.

Furthermore, it’s essential to consult with a qualified tax advisor or professional experienced in 1031 exchanges. They can help you navigate the complex tax rules and regulations, ensuring that you meet all the requirements and maximize your tax-deferred benefits. They can also provide valuable insights and strategies tailored to your specific situation, helping you make informed decisions and achieve your financial goals.

Avoiding Potential Tax Pitfalls

To avoid potential tax pitfalls in a 1031 exchange, it is important to carefully consider the tax basis determination of your properties. Failing to accurately determine the tax basis can result in unexpected tax liabilities and penalties. Here are some common pitfalls to watch out for and how to avoid them:

| Pitfall | Explanation | Solution |

|---|---|---|

| Incorrect basis calculation | If you miscalculate the basis of your relinquished property or replacement property, you could end up paying more taxes than necessary. | Double-check your calculations and consult with a tax professional to ensure accuracy. |

| Misclassifying expenses | Improperly categorizing expenses as capital improvements rather than routine repairs can inflate the basis and lead to a higher tax liability. | Keep detailed records of all expenses and consult with a tax professional to ensure proper classification. |

| Ignoring depreciation recapture | For properties that have been depreciated, failing to account for depreciation recapture can result in a higher tax burden. | Calculate the depreciation recapture and include it in your basis determination to avoid surprises at tax time. |

| Overlooking non-like-kind property | If you receive non-like-kind property as part of the exchange, you may need to recognize gain or loss on that property. Failure to do so can lead to inaccuracies in your tax basis. | Consult with a tax professional to properly calculate the basis of non-like-kind property and comply with tax regulations. |

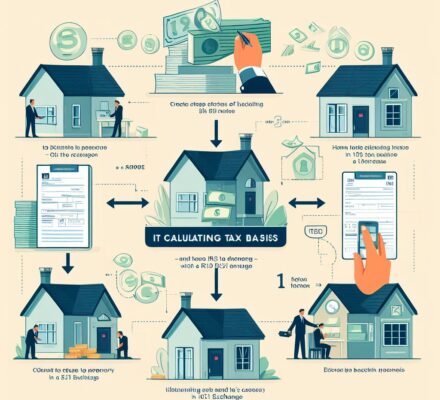

Calculating Tax Basis in 1031 Exchanges

Calculate the tax basis in your 1031 exchange by carefully determining the value of your properties. The tax basis is the starting point for calculating the gain or loss on the exchange. In a 1031 exchange, the tax basis of the relinquished property carries over to the replacement property. To calculate the tax basis, you need to consider several factors.

First, you need to determine the original cost basis of the relinquished property. This includes the purchase price, closing costs, and any improvements or capital expenditures made during ownership. Additionally, you need to reduce the cost basis by any depreciation claimed on the property.

Next, consider any adjustments to the tax basis. This includes any additional costs incurred during the exchange, such as closing costs, transfer taxes, and other expenses directly related to the exchange.

It is also important to factor in any mortgage or debt on the relinquished property. The amount of debt assumed or paid off during the exchange can affect the tax basis.

Finally, consider any boot received during the exchange. Boot refers to any non-like-kind property received in the exchange, such as cash or other assets. Boot is taxable and needs to be accounted for when calculating the tax basis.

Tips for Proper Tax Basis Determination

One important tip for properly determining the tax basis in a 1031 exchange is to thoroughly review all financial records. To accurately calculate the tax basis, you need to gather all relevant documents, such as property purchase agreements, closing statements, and depreciation schedules. These records will provide essential information about the original cost of the property, any improvements made, and the amount of depreciation taken over the years.

In addition to reviewing financial records, it’s crucial to consult with a qualified tax professional who specializes in 1031 exchanges. They can guide you through the process and help ensure that you comply with all IRS regulations. They can also provide valuable insights into the proper determination of the tax basis and any adjustments that may be necessary.

Furthermore, it’s important to keep detailed records of any additional costs incurred during the ownership of the property. This includes expenses such as repairs, maintenance, and capital improvements. These costs can be added to the tax basis and may reduce the amount of taxable gain in the exchange.

Lastly, it’s crucial to accurately report the tax basis on your tax return. Any errors or omissions in reporting the tax basis can lead to potential IRS audits and penalties. By following these tips and working with a knowledgeable professional, you can ensure a proper tax basis determination in your 1031 exchange.

Frequently Asked Questions

What Are the Specific Requirements to Qualify for a 1031 Exchange?

To qualify for a 1031 exchange, you must meet specific requirements. These include identifying a replacement property within 45 days and completing the exchange within 180 days. Consult a tax professional for accurate guidance.

Can Personal Property Be Included in a 1031 Exchange?

Yes, personal property can be included in a 1031 exchange. However, it must meet certain requirements such as being used for business or investment purposes. Consult with a tax professional for guidance.

Are There Any Time Limitations for Completing a 1031 Exchange?

You must complete a 1031 exchange within 180 days, including any extensions. Failure to meet this time limitation could result in the disqualification of your exchange and the potential for significant tax consequences.

What Happens if the Replacement Property Acquired in a 1031 Exchange Is Sold Within a Certain Period of Time?

If the replacement property acquired in a 1031 exchange is sold within a certain period of time, you may not be able to defer your tax liability and could be subject to paying capital gains taxes.

Are There Any Exceptions or Limitations on the Types of Properties That Can Be Exchanged in a 1031 Exchange?

Exceptions and limitations exist in 1031 exchanges regarding the types of properties that can be exchanged. It’s crucial to understand these rules to ensure compliance and avoid potential tax consequences.