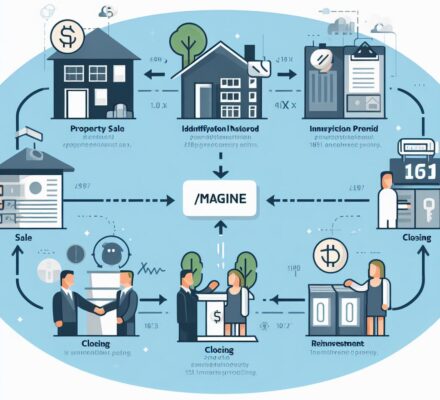

Are you wondering why replacement properties are so crucial for a 1031 exchange? Well, look no further.

In this article, we’ll dive into the importance of replacement properties and how they can help you maximize tax deferral benefits, meet important deadlines, ensure equal or greater value, preserve the like-kind requirement, and avoid potential tax liabilities.

So, let’s get started and explore why these properties are absolutely essential for a successful 1031 exchange.

Key Takeaways

- Carefully select and acquire replacement properties

- Meeting the 45-day identification period deadline

- Ensuring equal or greater value in replacement properties

- Preserving the like-kind requirement for eligible properties

Maximizing Tax Deferral Benefits

To maximize your tax deferral benefits in a 1031 exchange, it’s essential to carefully select and acquire replacement properties. This is a crucial step in the process as it determines the success of your exchange and the potential tax savings you can achieve. When choosing replacement properties, it’s important to consider factors such as location, market demand, and potential for future appreciation. By investing in properties that align with your investment goals and have the potential for long-term growth, you can ensure that you’re maximizing your tax deferral benefits.

In addition to selecting the right properties, it’s also important to acquire them within the designated timeline. The Internal Revenue Service (IRS) requires that replacement properties be acquired within 180 days from the date of the sale of the relinquished property, or by the due date of your tax return, including extensions. This brings us to the next crucial step in the 1031 exchange process: meeting the 45-day identification period deadline.

Meeting the 45-Day Identification Period Deadline

Meeting the 45-Day Identification Period Deadline is a crucial step in maximizing your tax deferral benefits in a 1031 exchange as it ensures that you adhere to the IRS requirement of identifying replacement properties within a specific timeframe. Here’s why meeting this deadline is so important:

- Time is of the essence: The 45-day identification period starts on the day you transfer the relinquished property and ends exactly 45 days later. This limited timeframe means you need to act swiftly and efficiently to identify potential replacement properties that meet your investment goals.

- Flexibility in identification: During this period, you have the flexibility to identify up to three potential replacement properties without any restrictions on their value. This allows you to explore various options and select the properties that best align with your investment objectives.

- Navigating unforeseen circumstances: Meeting the 45-day deadline provides you with a buffer in case any unexpected issues arise. It allows you to adjust your identification if a potential replacement property becomes unavailable or is no longer suitable for your needs.

Ensuring Equal or Greater Value in Replacement Properties

You should always ensure that your replacement properties have equal or greater value in a 1031 exchange. This is a crucial aspect of the exchange process because it allows you to defer capital gains taxes on the sale of your original property. By investing the entire proceeds from the sale into a replacement property of equal or greater value, you’re able to maintain the same investment position and defer the taxes that would have been due.

Ensuring equal or greater value in your replacement properties isn’t only important for tax purposes, but also for maintaining your financial position. If you were to invest in a replacement property of lesser value, you wouldn’t only have to pay taxes on the difference, but you’d also be reducing your overall investment. This can have a significant impact on your long-term financial goals.

To ensure equal or greater value in your replacement properties, it’s important to carefully consider the market value of the properties you’re considering. Conduct a thorough analysis of the property’s location, condition, and potential for appreciation. It’s also advisable to work with a qualified real estate professional who can help you identify properties that meet your investment criteria and have the potential for growth.

Preserving the Like-Kind Requirement for Eligible Properties

Maintaining the like-kind requirement is essential when selecting eligible replacement properties in a 1031 exchange, as it ensures the continuation of tax deferral and upholds the investment objectives established in the previous subtopic.

To better understand the significance of preserving the like-kind requirement, consider the following scenarios:

- Imagine you own a residential rental property that you want to exchange for a commercial property. If the replacement property isn’t of like-kind, such as exchanging a house for a car dealership, the transaction wouldn’t qualify for tax deferral. This would mean that you’d be liable for capital gains tax on the sale of the relinquished property.

- Now envision you have a property with multiple rental units that you wish to exchange for a larger apartment complex. By adhering to the like-kind requirement, you can defer the tax liability on the capital gains from the sale of the relinquished property and invest those funds into a property that better aligns with your investment objectives.

- Lastly, picture a situation where you want to exchange a piece of vacant land for a shopping center. By ensuring the replacement property is of like-kind, you can continue to defer taxes on the capital gains and potentially increase your investment income through rental revenue from the shopping center.

Preserving the like-kind requirement is crucial to maintain the tax benefits and investment goals established in a 1031 exchange. It allows investors to defer capital gains tax and reinvest their funds into properties that better suit their objectives. By following this requirement, investors can avoid boot and potential tax liabilities that could arise from non-compliance.

Avoiding Boot and Potential Tax Liabilities

To avoid potential tax liabilities and boot in a 1031 exchange, it’s important to carefully select replacement properties that meet the like-kind requirement. One crucial aspect to consider is the nature of the replacement property. In order to qualify for a tax-deferred exchange under Section 1031 of the Internal Revenue Code, the replacement property must be of like-kind to the relinquished property. This means that the replacement property must be of the same nature or character as the relinquished property. For example, if you’re exchanging a commercial property, the replacement property should also be a commercial property. However, the specific details of the properties, such as location or quality, don’t matter as long as they meet the like-kind requirement.

Another important consideration is the timing of the exchange. To avoid boot and potential tax liabilities, you must identify the replacement property within 45 days of the sale of the relinquished property. Additionally, you must acquire the replacement property within 180 days of the sale. These timeframes are strict and must be followed to qualify for a tax-deferred exchange.

Furthermore, it’s crucial to work with a qualified intermediary (QI) who’ll hold the proceeds from the sale of the relinquished property and assist in the acquisition of the replacement property. The QI will ensure that the exchange is structured properly and that the funds aren’t touched by the taxpayer, as this could result in the recognition of taxable gain.

Frequently Asked Questions

What Are the Consequences of Not Meeting the 45-Day Identification Period Deadline in a 1031 Exchange?

If you don’t meet the 45-day identification period deadline in a 1031 exchange, you risk losing the opportunity to defer capital gains taxes. It’s crucial to carefully adhere to the timeline to ensure a successful exchange.

Can Replacement Properties Be Located Anywhere in the United States or Are There Specific Restrictions?

When it comes to replacement properties for a 1031 exchange, there are specific restrictions. These properties can’t be located just anywhere in the United States. It’s important to understand the rules and limitations before proceeding.

How Can I Ensure That the Replacement Properties I Choose Have Equal or Greater Value Compared to the Relinquished Property?

To ensure the replacement properties you choose have equal or greater value compared to the relinquished property, you should carefully evaluate their market value and seek professional guidance to make informed decisions.

Are There Any Limitations on the Types of Properties That Qualify as Like-Kind for a 1031 Exchange?

There are limitations on the types of properties that qualify as like-kind for a 1031 exchange. It’s crucial to understand these limitations to ensure your replacement properties meet the requirements.

What Are Some Common Examples of Boot in a 1031 Exchange and How Can I Avoid It?

To avoid boot in a 1031 exchange, make sure the value of the replacement property is equal to or greater than the relinquished property. This way, you won’t have to worry about receiving any taxable cash or other property in return.