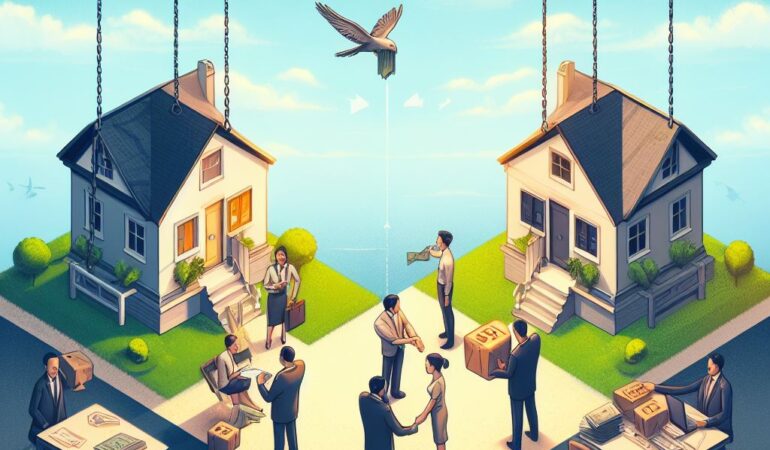

Do you know the difference between a reverse exchange and a 1031 exchange? If not, you’ve come to the right place. In this article, we will explore the key distinctions and considerations between these two tax-deferred exchange options.

By understanding their definitions, tax implications, and benefits, you can make informed decisions when it comes to your real estate investments.

So let’s dive in and discover the nuances of reverse exchange and 1031 exchange.

Key Takeaways

- Reverse exchange allows acquisition of replacement property before selling existing property, while 1031 exchange sells relinquished property first.

- Reverse exchange provides flexibility and avoids potential delays in the real estate market, while 1031 exchange allows for the reinvestment of profits and diversification of real estate holdings.

- Reverse exchange allows deferral of capital gains taxes and securing desirable replacement property before it’s sold to someone else, while 1031 exchange defers capital gains taxes and allows for increased cash flow and potential long-term wealth accumulation.

- Reverse exchange may require alternative financing and is more complex and costly compared to traditional 1031 exchange, while 1031 exchange can be easier to finance using proceeds from the sale of the relinquished property.

Definition of Reverse Exchange

To understand the difference between a reverse exchange and a 1031 exchange, you need to know the definition of a reverse exchange.

A reverse exchange is a type of real estate transaction that allows an investor to acquire a replacement property before selling their existing property. This is the opposite of a traditional exchange, where the investor sells their property first and then acquires a replacement property within a specified time frame.

In a reverse exchange, the investor typically forms a limited liability company (LLC) to hold the replacement property temporarily until their existing property is sold. The LLC then transfers the replacement property to the investor as part of the exchange.

This type of exchange is advantageous in situations where the investor finds a desirable replacement property but hasn’t yet been able to sell their existing property. It provides flexibility and allows the investor to avoid potential delays or missed opportunities in the real estate market.

However, reverse exchanges can be complex and require careful planning and compliance with IRS regulations. It’s important to consult with a qualified intermediary and tax advisor when considering a reverse exchange.

Definition of 1031 Exchange

A 1031 exchange allows you to defer capital gains taxes by exchanging one investment property for another similar property. This tax-deferral strategy is authorized by the Internal Revenue Code Section 1031, hence the name.

Here are five key points to understand about 1031 exchanges:

- Tax deferral: By utilizing a 1031 exchange, you can defer paying capital gains taxes on the sale of your investment property, allowing you to reinvest the full proceeds into a new property.

- Like-kind requirement: To qualify for a 1031 exchange, the property you sell and the property you acquire must be of ‘like-kind’. This means they must be of the same nature or character, even if they differ in quality or grade.

- Strict timelines: There are strict timelines that must be followed in a 1031 exchange. You have 45 days from the sale of your property to identify potential replacement properties and 180 days to complete the exchange.

- Qualified intermediaries: A qualified intermediary is required to facilitate the 1031 exchange. They hold the proceeds from the sale of your property and use them to acquire the replacement property on your behalf.

- Exclusions and limitations: Certain properties, such as personal residences, aren’t eligible for a 1031 exchange. Additionally, there are limitations on the value of the replacement property and the amount of debt that can be carried over. It’s important to consult with a tax professional to understand these exclusions and limitations.

Understanding the basics of a 1031 exchange can help you make informed decisions when it comes to your investment properties and tax obligations.

Tax Implications and Benefits of Reverse Exchange

When considering a reverse exchange, you should be aware of the potential tax implications and benefits.

A reverse exchange allows you to acquire replacement property before disposing of your relinquished property, which can be advantageous in certain situations.

One major tax implication of a reverse exchange is that it allows you to defer capital gains taxes. By acquiring the replacement property first, you can defer the recognition of capital gains until the later sale of the relinquished property. This can provide you with more flexibility and potentially save you money in taxes.

Another benefit of a reverse exchange is that it allows you to secure a desirable replacement property before it’s sold to someone else. This can be especially beneficial in competitive real estate markets where properties may be in high demand. By acquiring the replacement property first, you can ensure that you have the property you want without having to worry about it being sold to someone else during the exchange process.

However, it’s important to note that a reverse exchange can be more complex and costly compared to a traditional 1031 exchange. This is because it requires the use of a qualified intermediary and adherence to strict IRS guidelines. Additionally, there may be additional financing costs involved in the reverse exchange process.

Tax Implications and Benefits of 1031 Exchange

If you’re considering a 1031 exchange, you can enjoy tax benefits and implications that can help you defer capital gains taxes and maximize your investment opportunities.

Here are five key tax benefits and implications of a 1031 exchange:

- Tax deferral: By exchanging your property for a like-kind property, you can defer paying capital gains taxes on the sale of your property. This allows you to reinvest your profits and potentially increase your overall investment portfolio.

- Increased cash flow: By deferring taxes, you can keep more money in your pocket to reinvest in income-producing properties, resulting in increased cash flow and potential for long-term wealth accumulation.

- Portfolio diversification: A 1031 exchange gives you the opportunity to diversify your real estate holdings. You can exchange a property for a different type of property in a different location, allowing you to spread your investment risk and potentially increase your returns.

- Estate planning advantages: By utilizing a 1031 exchange, you can transfer your real estate investments to future generations without incurring immediate tax liabilities. This can be a useful strategy for preserving wealth and passing it on to your heirs.

- Wealth accumulation: By continually reinvesting in like-kind properties through 1031 exchanges, you can accumulate wealth over time. This strategy allows you to leverage your investment and potentially achieve higher returns than if you were to simply sell and pay taxes on your gains.

These tax benefits and implications make a 1031 exchange an attractive option for investors looking to defer taxes and maximize their investment opportunities.

Key Differences and Considerations

To distinguish between a reverse exchange and a 1031 exchange, it’s important to understand their key differences and considerations. One of the main differences is the timing of the exchange. In a 1031 exchange, the relinquished property is sold first, and then the replacement property is acquired within a specific timeframe. On the other hand, in a reverse exchange, the replacement property is acquired first, and then the relinquished property is sold within a certain period. This difference in timing can impact the overall strategy and flexibility of the exchange.

Another key difference is the financing options available. In a 1031 exchange, the funds from the sale of the relinquished property are typically used to purchase the replacement property. However, in a reverse exchange, the investor may need to secure alternative financing, as the replacement property is acquired before the sale of the relinquished property.

Additionally, there are different considerations when it comes to the identification of replacement properties. In a 1031 exchange, the investor must identify potential replacement properties within 45 days of selling the relinquished property. In a reverse exchange, the identification of the relinquished property must be made within 45 days of acquiring the replacement property.

These key differences and considerations should be carefully evaluated when deciding between a reverse exchange and a 1031 exchange, as they can have significant implications on the overall success of the transaction.

Frequently Asked Questions

What Are the Time Limitations for Completing a Reverse Exchange or a 1031 Exchange?

For both reverse exchange and 1031 exchange, the time limitations for completing the process depend on certain factors. These factors include the identification period and the exchange period, which may vary based on individual circumstances.

Can I Use a Reverse Exchange or a 1031 Exchange for Personal Property, or Is It Only Applicable to Real Estate?

You can only use a reverse exchange or a 1031 exchange for real estate, not personal property. They both have time limitations, so make sure to plan accordingly.

Are There Any Restrictions on the Type of Property That Can Qualify for a Reverse Exchange or a 1031 Exchange?

There are restrictions on the type of property that can qualify for a reverse exchange or a 1031 exchange. To determine eligibility, consult with a qualified intermediary or tax advisor.

How Does the Financing Aspect Differ Between a Reverse Exchange and a 1031 Exchange?

When it comes to financing, the key difference between a reverse exchange and a 1031 exchange is that in a reverse exchange, the replacement property is acquired before the relinquished property is sold.

What Are the Potential Risks or Challenges Associated With a Reverse Exchange or a 1031 Exchange?

You may encounter potential risks or challenges when engaging in a reverse exchange or a 1031 exchange. These include timing constraints, finding suitable replacement properties, and meeting IRS requirements for a successful exchange.