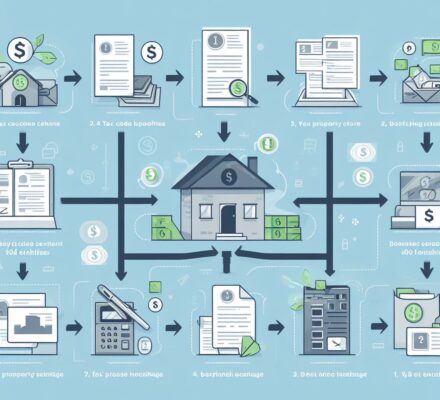

Imagine you’re about to embark on a complex financial journey.

You’re eager to learn the rules and regulations for 1031 exchanges, which can save you from paying hefty taxes.

In this concise article, we’ll delve into the eligible properties, identification period, exchange timelines, qualified intermediary, and tax reporting requirements.

Prepare to navigate this intricate process with confidence and emerge victorious, armed with the knowledge you need to make the most of your 1031 exchange opportunity.

Let’s get started!

Key Takeaways

- Eligible properties for a 1031 exchange include real estate held for investment or used in a trade or business, such as rental properties, commercial buildings, vacant land, and certain types of personal property used for business purposes.

- Primary residences do not qualify for a 1031 exchange.

- Both the relinquished property and the replacement property must be held for productive use in a trade or business or for investment purposes.

- The identification period lasts 45 calendar days, during which potential replacement properties must be identified, and the exchange period lasts 180 calendar days, within which the replacement property must be acquired and all necessary paperwork completed. Adhering to these timelines is crucial for a successful 1031 exchange.

Eligible Properties

To qualify for a 1031 exchange, you must ensure that your properties are eligible. Eligible properties for a 1031 exchange include real estate held for investment or used in a trade or business. This can include rental properties, commercial buildings, vacant land, and even certain types of personal property, such as equipment or vehicles used for business purposes. However, your primary residence doesn’t qualify for a 1031 exchange.

When it comes to real estate, both the relinquished property (the property you’re selling) and the replacement property (the property you’re acquiring) must meet certain criteria to be considered eligible. The IRS requires that both properties be held for productive use in a trade or business or for investment purposes. Additionally, the replacement property must be of equal or greater value than the relinquished property, and any cash or other proceeds received during the exchange must be reinvested into the new property.

Now that you understand the eligibility requirements for properties in a 1031 exchange, let’s move on to the next important aspect: the identification period.

Identification Period

During the identification period, you need to provide the IRS with a list of potential replacement properties. This is a crucial step in the 1031 exchange process as it determines the properties that you can potentially acquire.

Here are four important things to know about the identification period:

- Timelines: The identification period begins on the date of transferring the relinquished property and ends 45 calendar days later. It’s important to adhere to this strict timeline to avoid disqualification.

- Three Property Rule: You can identify up to three replacement properties without regard to their fair market value. This rule is commonly used to diversify your investment portfolio.

- 200% Rule: Instead of identifying three properties, you can identify any number of properties as long as their combined fair market value doesn’t exceed 200% of the relinquished property’s value. This rule allows for flexibility in identifying properties of higher value.

- 95% Rule: If you identify more than three replacement properties with a total value exceeding 200% of the relinquished property, you must acquire at least 95% of the identified properties’ value. This rule encourages investors to follow through with their identified properties.

Understanding these rules is critical to successfully navigating the identification period.

Now, let’s move on to the next section about exchange timelines, where we’ll explore the timeframes involved in a 1031 exchange.

Exchange Timelines

Now, let’s explore the timeline involved in a 1031 exchange and how it affects the process. The exchange timeline consists of two important periods: the identification period and the exchange period. During the identification period, which lasts 45 calendar days, you must identify potential replacement properties. You have the option to identify up to three properties of any value, or any number of properties as long as their total value does not exceed 200% of the value of the relinquished property.

Once the identification period ends, you have 180 calendar days to complete the exchange. This is known as the exchange period. Within this timeframe, you must acquire the replacement property and complete all necessary paperwork. It is crucial to adhere to these timelines to ensure a successful 1031 exchange.

To provide a visual representation, here is a table illustrating the exchange timelines:

| Exchange Timelines | Duration |

|---|---|

| Identification Period | 45 days |

| Exchange Period | 180 days |

Qualified Intermediary

Wondering how to navigate the role of a qualified intermediary in a 1031 exchange? A qualified intermediary (QI) is a crucial player in facilitating a successful 1031 exchange. Here are four key points to consider:

- Definition: A QI is a neutral third party who facilitates the exchange by holding the proceeds from the sale of the relinquished property and acquiring the replacement property on behalf of the taxpayer.

- Role and Responsibilities: The QI’s primary role is to ensure that the exchange complies with the strict rules and regulations set forth by the Internal Revenue Service (IRS). They handle all the paperwork, coordinate with the involved parties, and safeguard the funds during the exchange process.

- Importance of Choosing a Qualified Intermediary: It’s imperative to select a QI with extensive experience and expertise in 1031 exchanges. They should have a thorough understanding of the regulations and be able to guide you through the process smoothly.

- Time Constraints: The IRS imposes strict timelines on 1031 exchanges, and the QI plays a crucial role in ensuring compliance. They must be proactive in facilitating the exchange within the specified timeframes to avoid disqualification.

Navigating the role of a qualified intermediary can be complex, but with the right QI by your side, you can streamline your 1031 exchange and maximize your tax benefits.

Tax Reporting Requirements

To ensure compliance with IRS regulations, you must fulfill certain tax reporting requirements in a 1031 exchange. These requirements are crucial for accurately reporting the transaction and avoiding any potential penalties or audits. Here are the key tax reporting requirements you need to be aware of:

| Requirement | Description |

|---|---|

| Form 8824 | You must file Form 8824, Like-Kind Exchanges, with your tax return for the year in which the exchange occurred. This form provides the necessary information about the relinquished property, replacement property, and any boot received or given in the exchange. It helps the IRS track and verify the exchange transaction. |

| Reporting Timeframe | The form must be filed by the due date of your tax return, including extensions. It is essential to meet this deadline to avoid penalties or potential disqualification of the exchange. |

| Identification Statement | Along with Form 8824, you must also include an identification statement with your tax return. This statement should detail the properties involved in the exchange, including their legal descriptions and addresses. |

| Partnership Reporting | If the exchange involves a partnership, additional reporting requirements apply. The partnership must file Form 1065, U.S. Return of Partnership Income, and provide each partner with a Schedule K-1, which reports their share of the exchange transaction. |

Frequently Asked Questions

Can a 1031 Exchange Be Used for Personal Residences or Vacation Homes?

Yes, a 1031 exchange can be used for personal residences or vacation homes. However, there are specific rules and regulations that must be followed in order to qualify for this type of exchange.

Are There Any Restrictions on the Types of Properties That Can Be Exchanged in a 1031 Exchange?

There are restrictions on the types of properties that can be exchanged in a 1031 exchange. You must exchange like-kind properties, meaning they must be of the same nature or character.

Is There a Time Limit for Identifying Replacement Properties During the Identification Period?

During the identification period, you must identify potential replacement properties within 45 days. The time limit is strict and cannot be extended, so be sure to act promptly to meet this requirement.

What Happens if the Exchange Timeline Is Not Met for a 1031 Exchange?

If the exchange timeline is not met for a 1031 exchange, you may face potential tax consequences. It’s important to adhere to the rules and regulations to avoid any complications in your exchange process.

Are There Any Specific Requirements or Qualifications for a Qualified Intermediary in a 1031 Exchange?

To ensure a successful 1031 exchange, it’s crucial to have a qualified intermediary. They must meet specific requirements and qualifications, such as being independent and not having any prohibited relationships with you.