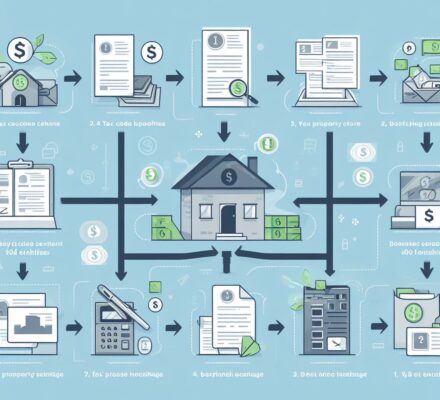

If you’re looking to maximize your real estate investments, then understanding 1031 exchange rules is crucial. In this step-by-step guide, we’ll walk you through the process to ensure a successful exchange.

You’ll learn how to determine your eligibility, identify replacement properties, and complete the exchange process seamlessly.

Plus, we’ll delve into the tax implications and provide valuable tips to help you navigate this complex process.

Get ready to take your real estate investments to the next level with our comprehensive guide.

Key Takeaways

- Eligible properties for a 1031 exchange must be held for productive use in a trade or business, or for investment purposes, and personal residences or properties primarily held for personal use do not qualify.

- In a 1031 exchange, the properties involved must be like-kind, meaning they are of the same nature or character. Real estate can be exchanged for other real estate, but not for other types of assets.

- When identifying replacement properties, they must be like-kind to the relinquished property, and the IRS allows for the identification of up to three potential replacement properties. Alternatively, any number of properties can be identified as long as their total fair market value does not exceed 200% of the relinquished property’s value.

- To complete the exchange process, a Qualified Intermediary (QI) must be engaged to facilitate the exchange, necessary documentation must be prepared, title of the relinquished property must be transferred, written identification of replacement property must be provided within a specified timeframe, and funds held by the QI must be used to acquire the replacement property within the designated exchange period.

Determining Eligibility

To determine your eligibility for a 1031 exchange, you’ll need to meet specific criteria outlined by the IRS. The first requirement is that both the property you’re selling (relinquished property) and the property you’re acquiring (replacement property) must be held for productive use in a trade or business, or for investment purposes. This means that personal residences or properties primarily held for personal use don’t qualify for a 1031 exchange.

Another important criterion is that the properties involved in the exchange must be like-kind. This doesn’t mean that the properties have to be identical, but rather that they’re of the same nature or character. For example, you can exchange a residential rental property for a commercial property, or a vacant land for an apartment building. However, you can’t exchange real estate for other types of assets, such as stocks or vehicles.

Furthermore, there are strict time frames that you must adhere to in order to qualify for a 1031 exchange. You have 45 days from the sale of your relinquished property to identify potential replacement properties, and 180 days to complete the exchange by acquiring the replacement property. These time limits are non-negotiable and failure to meet them will disqualify your exchange.

In addition, it’s important to note that the 1031 exchange is only available for real property located in the United States. Foreign properties or personal property don’t qualify for this tax-deferred exchange.

Understanding the eligibility criteria for a 1031 exchange is crucial to ensure that you can take advantage of the tax benefits it offers. It’s recommended to consult with a qualified tax professional or real estate advisor to guide you through the process and help you determine if you meet all the necessary requirements.

Identifying Replacement Properties

When identifying replacement properties for a 1031 exchange, you need to consider certain factors to ensure compliance with IRS rules. It is crucial to understand the requirements and limitations set forth by the IRS to successfully complete a tax-deferred exchange. One of the key aspects of a 1031 exchange is the identification of suitable replacement properties within a specific time frame.

To help you navigate this process, here is a table outlining the key factors to consider when identifying replacement properties:

| Factors to Consider | Description |

|---|---|

| Property Type | The replacement property must be like-kind to the relinquished property. This means it should be of the same nature, character, or class. For example, a commercial property can be exchanged for another commercial property or even vacant land. |

| Number of Properties to Identify | The IRS allows you to identify up to three potential replacement properties, regardless of their value. Alternatively, you can identify any number of properties as long as their total fair market value does not exceed 200% of the relinquished property’s value. |

| 45-Day Identification Period | You have 45 days from the date of the relinquished property’s sale to identify the replacement properties. It is essential to meet this deadline to comply with IRS requirements. |

| Specificity | The identification must be specific and unambiguous. It should include the legal description or address of each property to eliminate any confusion or ambiguity. |

Completing the Exchange Process

Once you have identified suitable replacement properties, it’s time to proceed with completing the exchange process. This is a crucial step towards successfully executing a 1031 exchange. Here are the key steps involved:

- Engage a Qualified Intermediary (QI): Select a reputable QI who’ll facilitate the exchange by holding and transferring the funds between the sale of your relinquished property and the purchase of your replacement property.

- Prepare Exchange Documents: Work with your QI to prepare the necessary documentation, including the Exchange Agreement and Assignment of Purchase and Sale Agreement, to ensure compliance with the 1031 exchange rules.

- Sell Your Relinquished Property: Transfer the title of your relinquished property to the buyer and instruct your QI to receive the funds from the sale.

- Identify Replacement Property: Provide your QI with a written identification of the replacement property or properties within the specified timeframe.

- Purchase Replacement Property: Use the funds held by your QI to acquire the replacement property within the designated exchange period.

By following these steps and adhering to the 1031 exchange rules, you can successfully complete the exchange process and defer your capital gains taxes.

It’s crucial to consult with a qualified tax professional and experienced QI to navigate the intricacies of the 1031 exchange and ensure compliance with all applicable regulations.

Understanding Tax Implications

To fully comprehend the 1031 exchange rules, it is essential for you to understand the tax implications involved. One of the main benefits of a 1031 exchange is the ability to defer capital gains taxes on the sale of your investment property. However, it is important to note that the tax implications can vary depending on your specific situation and the type of property involved.

To help you better understand the tax implications of a 1031 exchange, let’s take a look at the following table:

| Tax Implication | Explanation |

|---|---|

| Capital Gains Tax | The profit made from the sale of your investment property is subject to capital gains tax. However, in a 1031 exchange, this tax can be deferred if you reinvest the proceeds into a like-kind property. |

| Depreciation Recapture | If you have claimed depreciation on your investment property, you may be subject to depreciation recapture tax when you sell it. In a 1031 exchange, this tax can also be deferred if you reinvest in a like-kind property. |

| State Taxes | Apart from federal taxes, you may also be liable for state taxes on the sale of your property. The rules regarding state taxes can vary depending on your state of residence. It is important to consult with a tax professional to understand the specific implications in your state. |

| Estate Taxes | In certain cases, estate taxes may apply to the sale of your investment property. However, a 1031 exchange does not provide any estate tax benefits. |

Understanding the tax implications of a 1031 exchange is crucial for making informed decisions about your investment strategy. Consult with a tax professional to fully understand the implications specific to your situation and ensure compliance with all applicable tax laws.

Tips for a Successful 1031 Exchange

To ensure a successful 1031 exchange, it’s crucial that you carefully consider these tips and strategies:

- Plan Ahead: Start planning your exchange well in advance to give yourself ample time to find suitable replacement properties and complete all necessary paperwork.

- Consult a Qualified Intermediary: Working with a qualified intermediary is essential to ensure compliance with IRS regulations and to facilitate a smooth exchange process.

- Do Your Due Diligence: Thoroughly research potential replacement properties to make sure they meet your investment goals and are in line with your overall investment strategy.

- Consider Multiple Options: Don’t limit yourself to one potential replacement property. Explore different options to increase your chances of finding the best fit for your needs.

- Understand the Timelines: Familiarize yourself with the strict timelines involved in a 1031 exchange, such as the identification period and the exchange period, to avoid any unnecessary complications.

By following these tips, you can enhance your chances of a successful 1031 exchange. Planning ahead and consulting with professionals will help you navigate the complexities of the process.

Performing thorough due diligence and considering multiple options will ensure that you find the right replacement property.

Finally, understanding the timelines involved will help you stay on track and avoid any potential pitfalls.

Frequently Asked Questions

Can I Use a 1031 Exchange to Swap My Primary Residence for Another Property?

Yes, you can use a 1031 exchange to swap your primary residence for another property. This allows you to defer capital gains taxes on the sale of your current home.

Is There a Time Limit for Identifying Replacement Properties in a 1031 Exchange?

Yes, there is a time limit for identifying replacement properties in a 1031 exchange. You have 45 days from the date you sell your property to identify potential replacement properties.

Can I Use a 1031 Exchange to Defer Capital Gains Taxes on the Sale of a Rental Property?

Yes, you can use a 1031 exchange to defer capital gains taxes on the sale of a rental property. This allows you to reinvest the proceeds into a like-kind property and defer the taxes until the new property is sold.

Are There Any Restrictions on the Type of Property That Can Be Exchanged in a 1031 Exchange?

You can exchange almost any type of real property in a 1031 exchange. From residential homes to commercial buildings, the possibilities are vast. However, there are a few restrictions, so be sure to consult with a professional.

Can I Use a 1031 Exchange to Exchange a Property Located in One State for a Property Located in Another State?

Yes, you can use a 1031 exchange to exchange a property located in one state for a property located in another state. There are no restrictions on exchanging properties across state lines.