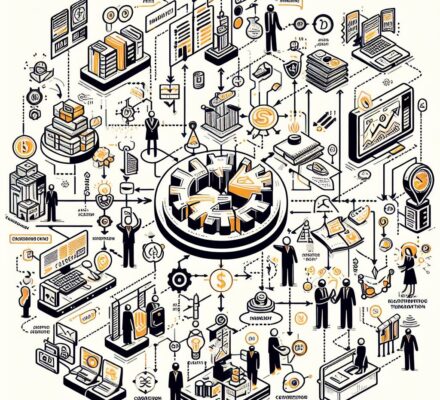

Imagine you’re about to embark on a 1031 exchange, eager to make the most of your investment. But before you proceed, it’s crucial to understand the risks associated with related party transactions.

In this article, we’ll guide you through the process of mitigating these risks. By identifying such transactions, understanding the legal implications, and implementing proper due diligence, you can ensure compliance with IRS regulations and establish fair market value.

Let’s dive in and safeguard your 1031 exchange.

Key Takeaways

- Regularly review and identify related party transactions to ensure compliance and mitigate risks in your 1031 exchange.

- Thoroughly investigate related party transactions through proper due diligence to protect your investment.

- Gather comparable property data and engage an independent appraiser to establish fair market value.

- Ensure compliance with IRS regulations by conducting a thorough analysis, maintaining proper documentation, and filing necessary forms.

Identifying Related Party Transactions

You should regularly review and identify related party transactions to ensure compliance and mitigate risks in your 1031 exchange. Identifying these transactions is crucial because they involve parties who have a close relationship with you, such as family members, business partners, or entities controlled by you. These transactions may pose a higher risk of non-compliance or abuse of the 1031 exchange rules.

To identify related party transactions, start by reviewing your records and documentation related to your exchange. Look for any transactions involving parties who are connected to you in a personal or business capacity. This could include purchases or sales of property, loans, leases, or any other type of financial transaction.

Additionally, you should review any contracts or agreements that you have entered into with related parties. Pay close attention to the terms and conditions of these agreements, ensuring that they are fair and at arm’s length.

It is also important to consult with your tax advisor or legal counsel to ensure that you are accurately identifying related party transactions and complying with all relevant regulations. They can provide guidance and help you navigate any complexities or potential risks associated with these transactions.

Understanding the Legal Implications

To fully safeguard your 1031 exchange and minimize potential legal risks, it’s essential to comprehend the legal implications associated with related party transactions. Understanding the legal aspects will enable you to navigate these transactions with confidence and ensure compliance with the law. Here are four key points to consider:

- Tax implications: Related party transactions can have significant tax consequences. It’s crucial to understand how these transactions can impact your tax liability and ensure compliance with tax regulations.

- IRS scrutiny: The Internal Revenue Service (IRS) closely scrutinizes related party transactions to ensure they’re conducted at fair market value. Failing to meet this requirement can result in penalties and potential disqualification of your 1031 exchange.

- Prohibited transactions: Certain transactions between related parties are prohibited in a 1031 exchange. Familiarize yourself with these restrictions to avoid engaging in prohibited activities and jeopardizing the validity of your exchange.

- Documentation and record-keeping: Proper documentation is crucial in related party transactions. Maintaining accurate records will provide evidence of the transaction’s legitimacy and help you defend against potential legal challenges.

By understanding the legal implications of related party transactions, you can mitigate risks and ensure a smooth 1031 exchange.

Now, let’s delve into the next section, which discusses implementing proper due diligence to further protect your exchange.

Implementing Proper Due Diligence

Proper due diligence plays a critical role in mitigating risks associated with related party transactions for a 1031 exchange.

When engaging in a related party transaction, it’s essential to thoroughly investigate the transaction to ensure compliance with regulations and to protect your investment. Conducting due diligence involves gathering and analyzing relevant information about the transaction, such as the financial statements of the related party and any potential conflicts of interest.

It’s important to review the terms of the transaction, including the purchase price, financing arrangements, and any lease agreements. Additionally, it’s crucial to evaluate the financial stability and reputation of the related party involved. By carefully examining these aspects, you can identify any potential red flags or risks that may arise from the transaction.

Furthermore, conducting proper due diligence allows you to make informed decisions and negotiate favorable terms that align with your investment goals. This will help ensure a successful 1031 exchange and minimize the likelihood of any negative consequences.

Moving forward, establishing fair market value will be the next step in the process of mitigating risks in related party transactions for a 1031 exchange.

Establishing Fair Market Value

Conducting thorough research and analysis is essential for establishing fair market value in related party transactions for a 1031 exchange. To ensure accuracy and mitigate risks, follow these steps:

- Gather comparable property data: Collect information on recent sales of similar properties in the same geographic area. This data will help you determine the fair market value of the property involved in the transaction.

- Consider property condition: Assess the condition of the property, including any needed repairs or renovations. Adjustments may need to be made to the fair market value based on the property’s current state.

- Engage an independent appraiser: Hire a qualified appraiser who has no personal or financial interest in the transaction. Their unbiased evaluation will provide an objective assessment of the property’s fair market value.

- Document the valuation process: Keep detailed records of the research, analysis, and appraisal used to establish fair market value. These documents will serve as evidence of the thoroughness and objectivity of the valuation process.

By following these steps, you can ensure that the fair market value of the property is accurately determined, reducing the risk of IRS scrutiny and penalties.

Now, let’s discuss the next important aspect of related party transactions: ensuring compliance with IRS regulations.

Ensuring Compliance With IRS Regulations

Ensure that you comply with IRS regulations for related party transactions in a 1031 exchange by following these guidelines. Adhering to these regulations is crucial to avoid potential penalties and ensure a successful transaction.

To help you understand and comply with the IRS regulations, refer to the table below:

| Guidelines for Compliance with IRS Regulations | Description |

|---|---|

| Conduct a thorough analysis of the transaction | Before proceeding with a related party transaction, carefully evaluate the terms, conditions, and fair market value of the properties involved. This analysis should be well-documented and supported by third-party appraisals. |

| Ensure adequate consideration is given | The exchange should involve a fair exchange of properties, with both parties receiving properties of similar value. The consideration given should be based on the fair market value determined by a qualified appraiser. |

| Maintain proper documentation and records | Keep detailed records of the transaction, including contracts, appraisals, and any other relevant documents. These records should demonstrate that the transaction was conducted at arm’s length and in compliance with IRS regulations. |

| File the necessary tax forms and report the transaction to the IRS | Properly report the related party transaction on your tax return and file any required forms, such as Form 8824. Failure to report the transaction or file the necessary forms can result in penalties. |

| Seek professional advice and consult with a qualified intermediary | Working with a qualified intermediary who specializes in 1031 exchanges can help ensure compliance with IRS regulations. They can provide guidance and help navigate the complexities of related party transactions. |

Frequently Asked Questions

How Do Related Party Transactions Affect the Eligibility for a 1031 Exchange?

Related party transactions can impact your eligibility for a 1031 exchange. It’s important to understand the rules and potential risks involved. Consulting with a tax professional can help you navigate this complex process.

Are There Any Specific Documentation Requirements for Related Party Transactions in a 1031 Exchange?

To mitigate risks in related party transactions for a 1031 exchange, specific documentation requirements must be met. Ensure you keep thorough records, including written agreements, fair market value appraisals, and proper reporting to the IRS.

What Are the Potential Penalties or Consequences for Non-Compliance With IRS Regulations in Related Party Transactions for a 1031 Exchange?

If you don’t comply with IRS regulations in related party transactions for a 1031 exchange, you may face penalties or consequences. It’s important to understand and follow the rules to avoid any potential issues.

Are There Any Limitations or Restrictions on the Types of Assets or Properties That Can Be Involved in Related Party Transactions for a 1031 Exchange?

There are limitations and restrictions on the types of assets or properties that can be involved in related party transactions for a 1031 exchange. You should consult IRS regulations for specific guidelines.

How Does the IRS Determine if the Fair Market Value Has Been Accurately Established in a Related Party Transaction for a 1031 Exchange?

The IRS determines if the fair market value has been accurately established in a related party transaction for a 1031 exchange by reviewing supporting documentation and assessing whether it aligns with market conditions.