Are you feeling overwhelmed by the complexities of determining tax basis in 1031 exchanges? Don’t worry, we’ve got you covered.

In this article, we’ll provide you with mistake-free tips to ensure accurate calculations. By understanding the concept of tax basis, gathering accurate documentation, and accounting for depreciation and improvements, you’ll be well-equipped to navigate this process with confidence.

So, let’s dive in and make sure you’re on the right track for a successful 1031 exchange.

Key Takeaways

- Accurate calculation of tax basis is essential in 1031 exchanges to comply with tax regulations and maximize benefits.

- Gathering important documents such as purchase agreement, closing statement, and documentation of improvements is crucial for determining tax basis.

- Determining the fair market value of the relinquished property requires researching current market conditions, identifying comparable sales, and considering a qualified appraiser.

- Accounting for depreciation and improvements is necessary to determine the adjusted basis and calculate gain or loss in the 1031 exchange.

Understanding the Concept of Tax Basis

To understand tax basis in 1031 exchanges, you need to grasp the concept of how it’s calculated and applied. Tax basis refers to the original cost or value of an asset for tax purposes.

In the context of a 1031 exchange, the tax basis of the relinquished property is transferred to the replacement property. This means that the tax liability is deferred, as the basis remains the same.

The calculation of tax basis involves several factors.

Firstly, you need to determine the purchase price of the property, which includes the actual cost plus any additional expenses like closing costs and legal fees.

Secondly, you need to consider any improvements made to the property, which increase the basis. Conversely, if there were any deductions or depreciation taken, these need to be subtracted from the basis.

Additionally, any deferred gain or loss from previous exchanges also affects the basis.

It’s crucial to accurately calculate the tax basis to ensure compliance with tax regulations and maximize the benefits of a 1031 exchange.

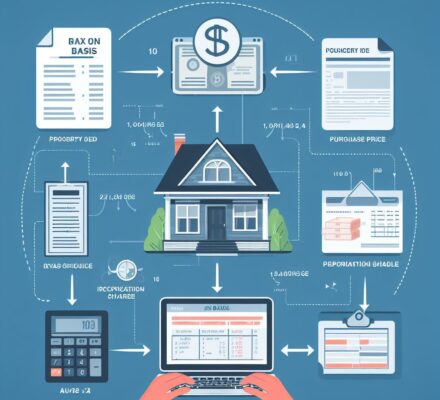

Gathering Accurate Documentation for Your Property

Now, let’s delve into gathering accurate documentation for your property, ensuring that you have all the necessary paperwork in order. This step is crucial in successfully completing a 1031 exchange and avoiding any complications with the IRS. To help you with this process, here are three key items to focus on:

- Property Purchase Agreement:

The purchase agreement is a vital document that outlines the terms and conditions of your property acquisition. It should include the purchase price, closing date, and any contingencies. Make sure to keep a copy of this agreement as it will serve as proof of your property’s acquisition.

- Closing Statement:

The closing statement, also known as the settlement statement or HUD-1, summarizes the financial transactions that occurred during the property purchase. It includes details such as the purchase price, loan amount, and closing costs. This document is essential for determining your property’s basis and should be provided by your closing agent.

- Property Improvements Documentation:

If you made any improvements or renovations to your property, gather all relevant documentation, such as invoices, receipts, and permits. These documents will help establish the cost of the improvements and increase your property’s basis.

Determining the Fair Market Value of Your Relinquished Property

To determine the fair market value of your relinquished property, you’ll need to gather and analyze relevant information related to its current market conditions and comparable sales. This process requires a technical and precise approach to ensure an accurate valuation.

Start by researching the current market conditions in your property’s location. This includes examining factors such as supply and demand, recent sales trends, and any economic or regulatory changes that may affect property values. Utilize reputable sources such as real estate market reports, local government data, and industry publications.

Next, identify comparable sales that closely resemble your property in terms of size, location, condition, and amenities. Analyze these sales to determine their sale prices and any adjustments that may be necessary to make them more comparable to your property. Factors such as differences in square footage, age, or recent renovations may require adjustments to reflect the fair market value accurately.

Consider enlisting the help of a qualified appraiser who specializes in the type of property you own. Appraisers have the expertise and access to data that can provide a comprehensive analysis of your property’s fair market value. Their professional opinion can be valuable when determining the accurate valuation of your relinquished property.

Accounting for Depreciation and Improvements

When determining the tax basis in 1031 exchanges, it’s important to account for depreciation and improvements made to the relinquished property. By properly accounting for these factors, you can ensure that you’re accurately calculating the adjusted basis of the property and avoid potential mistakes that could lead to tax liabilities.

Here are three key points to consider when accounting for depreciation and improvements:

- Depreciation: Depreciation is the reduction in value of a property over time due to wear and tear, deterioration, or obsolescence. It’s important to calculate and account for the depreciation taken on the property during the period of ownership. This will help you determine the adjusted basis of the property and accurately calculate any gain or loss in the 1031 exchange.

- Improvements: Improvements made to the property can increase its value and should be accounted for when determining the tax basis. This includes any renovations, additions, or upgrades that have been made to the property. By accurately documenting and valuing these improvements, you can ensure that they’re properly included in the adjusted basis calculation.

- Capitalization: Some expenses related to the property, such as repairs or maintenance, may need to be capitalized and added to the basis. It’s important to understand the IRS guidelines for capitalization versus deduction of expenses to ensure proper treatment and accurate basis calculation.

Seeking Professional Advice and Guidance

For accurate guidance on determining the tax basis in 1031 exchanges, consider consulting with a professional who specializes in tax planning and real estate transactions. Seeking professional advice and guidance is crucial in navigating the complexities of tax laws and regulations related to 1031 exchanges. Professionals who specialize in this area have in-depth knowledge and experience in handling these transactions, ensuring that you make informed decisions and avoid costly mistakes.

A qualified professional can help you accurately determine the tax basis by considering factors such as the purchase price of the relinquished property, any improvements made, and the depreciation taken. They can also assist in calculating the adjusted basis and identifying any potential tax liabilities or benefits. Their expertise can prove invaluable in maximizing your tax savings and ensuring compliance with all relevant tax laws.

When choosing a professional, look for someone who’s well-versed in tax planning and real estate transactions, preferably with a proven track record in successfully handling 1031 exchanges. It’s also important to select someone who stays up-to-date with the latest tax regulations and has a thorough understanding of the specific rules governing 1031 exchanges.

Frequently Asked Questions

What Are the Potential Consequences of Not Accurately Determining the Tax Basis in a 1031 Exchange?

If you don’t accurately determine the tax basis in a 1031 exchange, you could face potential consequences such as under-reporting or over-reporting your capital gains, which may lead to penalties or audits.

Are There Any Specific Forms or Documents That Need to Be Filed With the IRS to Report the Tax Basis in a 1031 Exchange?

To report the tax basis in a 1031 exchange, you’ll need to file specific forms or documents with the IRS. These filings are crucial for accurate reporting and avoiding potential consequences.

Can the Tax Basis Be Adjusted After the Completion of a 1031 Exchange?

Yes, the tax basis can be adjusted after completing a 1031 exchange. However, it is crucial to follow IRS regulations and properly document any adjustments to ensure accurate reporting and avoid potential mistakes.

How Does the Tax Basis Affect the Calculation of Capital Gains Taxes in a 1031 Exchange?

The tax basis plays a crucial role in calculating capital gains taxes in a 1031 exchange. It determines the amount of profit or loss and affects the tax implications of the transaction.

Is There a Time Limit for Determining the Tax Basis in a 1031 Exchange?

Yes, there is a time limit for determining the tax basis in a 1031 exchange. It must be done within 45 days after the property is transferred or by the due date of the tax return, including extensions.