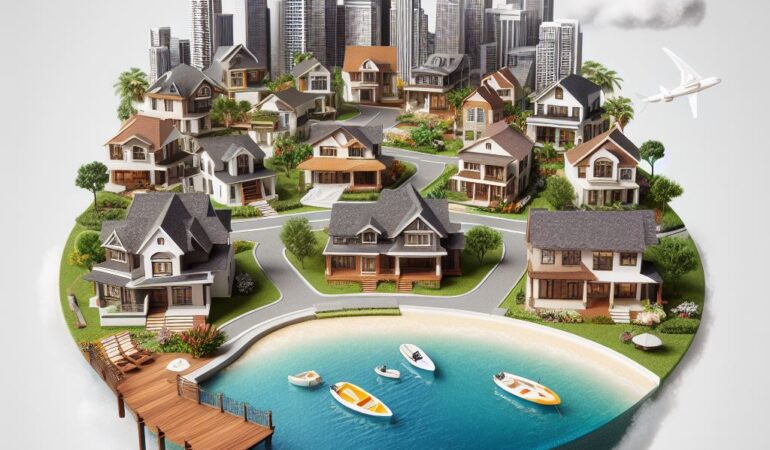

If you’re like most people, you probably have a diversified stock portfolio. You may have investments in different industries, and you’re not too worried about any single sector taking a hit. The same principle should apply when it comes to your real estate portfolio. You should never put all of your eggs in one basket, especially when it comes to real estate. In this article, we discuss how to diversify your real estate portfolio and protect yourself from potential downturns in the market.

Why It’s Important to Diversify Your Real Estate Portfolio

Think of diversification as a way to spread out your risk. If you diversify, you’re less likely to lose everything if one part of your portfolio fails, especially in real estate, because the costs associated with owning property can be very high. For example, if you purchase an apartment building that has 50 units in it, and 20% of those tenants stop paying rent due to a downturn in the market, then that’s $20k/month lost just from that one investment property alone!

That number could become much more than what would’ve happened had all 50 units remained occupied at their full rental rate. It’s important to diversify across different geographies and types, so there isn’t any single catastrophic event like an earthquake or hurricane that destroys all of your assets.

How To Diversify Your Real Estate Portfolio

There are several ways to diversify your real estate portfolio. You can diversify by geography, property type, and more! Here’s a list of some ideas:

– Buy in multiple markets (domestic vs international) with different economic conditions than where you currently live.

– Purchase residential and commercial real estate so there isn’t any single catastrophic event, like an earthquake or hurricane, that destroys all of your assets at once.

– Invest across various asset classes such as stocks/bonds/real estate funds instead of just one type, like REIT properties only.

– Invest in different types of real estate investments, including but not limited to: multifamily dwellings, single-family homes, townhomes, or condos; diversifying between them will help diversify your risk exposure.

The Benefits of Diversification

There are many benefits to diversifying your real estate portfolio. Not only does it give you more options for investment opportunities, but it also helps reduce the risk if one property is damaged or loses value due to a downturn in the market. If all of your eggs are in one basket and that basket gets dropped, there’s nothing left after everything has fallen apart. Having multiple sources of income protects against such catastrophic events happening at once.

The Different Types of Real Estate Investments Available

There are three main types of real estate investments available:

– Direct ownership – This is when you own the property yourself and can control decisions about it, such as renovations or renting out space.

– Indirect investment through REITs (Real Estate Investment Trust) – These allow investors to diversify their risk exposure by investing in a diversified portfolio without having direct ownership over any single asset class like stocks/bonds/real estate funds instead of just one type like REITs only.

– Real Estate ETFs (Exchange Traded Funds) give access to diversification at even lower price points than buying individual properties directly. They have more liquidity for trading purposes but less diversification due to the higher correlation between assets in these portfolios because they’re weighted towards residential properties over commercial ones.

By diversifying across multiple markets with different economic conditions than where you live, you have less investment risk of losing everything if one property is damaged or loses value due to a downturn in the market. They’re not all located within driving distance from each other, so there isn’t likely to be any catastrophic events happening at once that could affect both investments simultaneously, such as earthquakes/hurricanes, etc.

Diversification isn’t always enough protection, though. Some types of real estate are more susceptible to certain risks, like apartments being damaged by floods versus single-family homes, which might get hit by an earthquake instead. So diversifying your portfolio between these asset classes can add another layer of safety netting if something ever happened.

How to Choose the Right Type of Real Estate Investment for Your Portfolio

Now that you know diversification is important, how do you choose the right type of real estate investment for your portfolio? Here are some factors to consider when deciding if direct ownership or indirect investing through REITs will work best:

If the asset class doesn’t have any natural diversification, like residential properties versus commercial ones, then diversifying across multiple markets with different economic conditions than where you live is better. There won’t likely be any catastrophic events happening at one time that could affect both investments simultaneously, such as earthquakes/hurricanes, etc.

Residential property types tend not to diversify well on their own so diversifying between them and other asset classes helps protect against loss due to their higher correlation between assets in these portfolios since they’re typically weighted towards residential properties over commercial ones.

For more liquidity or faster diversification, ETFs are a better option. They trade on exchanges like stocks, so they can be bought and sold quickly; however, there are many more risks associated with these types of investments since they’re not as diversified as REITs.

How much time and effort are you willing to put into managing your real estate investment? With direct ownership, you manage it yourself, including finding tenants, handling repairs/maintenance issues, etc. With indirect investing through a REIT or ETF, you don’t have to do anything except decide how much money you want to allocate to this type of investment.

What’s your risk tolerance? If you’re not comfortable with a lot of risks, then REITs might be a better option because they’re less volatile than stocks and more correlated with the underlying real estate market.

What are your investment goals? Do you want regular income from rent payments, or are you looking for capital gains potential when you sell? Different types of investments will offer different benefits, so make sure to align your investment goals with the right investment vehicle.

The Benefits and Risks of Diversifying Your Portfolio with Real Estate

As you can see, there are many factors to consider when deciding if direct ownership or indirect investing through REITs will work best for you. Here are some of the benefits and risks associated with diversifying your portfolio with real estate:

Benefits:

Diversification – As we discussed earlier, one of the main benefits of including real estate in your portfolio is that it helps reduce overall risk because different types of assets perform differently under various economic conditions.

Liquidity – Another benefit of real estate investing is that it’s a more liquid investment than most other asset classes. You can sell your shares quickly if needed without waiting on a buyer to come along.

Tax Advantages – Depending on where you live, owning real estate may offer some tax advantages as well. For example, if you own rental properties, there are deductions available for depreciation and repairs made throughout the year, which can reduce your taxable income.

Risks:

Lack of sufficient diversification – One risk with diversifying into real estate is the time and effort required to manage these types of investments. This means any losses could have a bigger impact than other asset classes like stocks or bonds would suffer under similar circumstances. Another risk is diversifying too much so that all returns cancel each other out instead.

Difficult to diversify within real estate – Another potential problem is diversifying within the real estate by owning different properties. For example, if you have one rental property in an urban area and another in a rural area, they may not perform well at the same time due to factors like location or market conditions. This leads some investors to diversify too much, so all returns cancel each other out instead.

A Diversified Option

A popular real estate investment, multifamily real estate, is also a great way to diversify your real estate portfolio. When investing in multifamily properties, you get exposure to multiple markets simultaneously. You can find multifamily properties in most metropolitan and suburban areas across the United States.

Some of the benefits of multifamily real estate include:

- Diversification

- Liquidity

- Value appreciation potential

- Cash flow generation