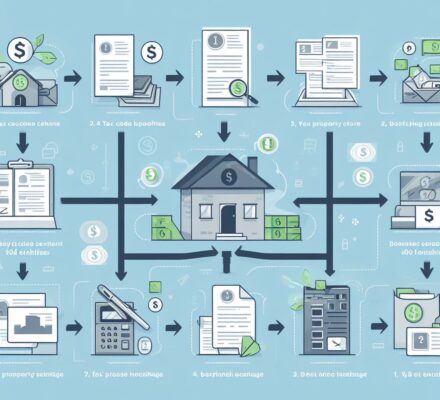

If you’ve ever wondered how to navigate the complexities of tax code section 1031 exchange, look no further. In this article, we’ve compiled essential tips to help you understand the basics, identify qualified properties, meet timing and deadlines, work with qualified intermediaries, and plan your taxes and exit strategies.

Don’t let the intricacies of the tax code deter you; with these tips, you’ll be well-equipped to make the most of your 1031 exchange.

Key Takeaways

- Section 1031 allows for deferring capital gains taxes by exchanging properties.

- Properties involved in the exchange must be held for productive use or investment and be of like-kind.

- Replacement properties must be identified within 45 days and the exchange must be completed within 180 days or by the tax return due date.

- Working with a qualified intermediary is necessary, and it is important to choose a reliable and experienced one who complies with IRS regulations.

Understanding the Basics

To understand the basics of a tax code Section 1031 exchange, you need to know the key principles and requirements involved. A Section 1031 exchange, also known as a like-kind exchange, allows you to defer capital gains taxes by exchanging one investment property for another. The primary requirement is that both properties must be held for productive use in a trade or business or for investment purposes. Personal residences don’t qualify for a Section 1031 exchange.

Another important principle is that the properties involved must be of like-kind. This means they must be of the same nature or character, even if they differ in grade or quality. For example, you can exchange a commercial property for a residential property, or vacant land for an office building.

Timing is crucial in a Section 1031 exchange. You must identify the replacement property within 45 days of transferring the relinquished property and complete the exchange within 180 days or by the due date of your tax return, whichever comes first. Failure to meet these deadlines can result in the disqualification of the exchange.

It is essential to work with a qualified intermediary who’ll facilitate the exchange and hold the funds during the process. The intermediary ensures compliance with the strict requirements of a Section 1031 exchange.

Understanding these key principles and requirements is fundamental to successfully navigating a tax code Section 1031 exchange.

Identifying Qualified Properties

When identifying qualified properties for a Section 1031 exchange, it’s important to consider the specific criteria and guidelines that determine eligibility. Here are some important points to keep in mind:

- Like-Kind Requirement: The property you’re exchanging must be of like-kind to the property you’re acquiring. This means that both properties must be of the same nature or character, such as exchanging a residential property for another residential property.

- Timing: You must identify potential replacement properties within 45 days of selling your current property. Additionally, you must complete the exchange within 180 days.

- Qualified Intermediary: To ensure compliance with the exchange requirements, it’s necessary to work with a qualified intermediary who’ll hold the proceeds from the sale of the relinquished property and facilitate the acquisition of the replacement property.

- Exclusions: Certain types of property, such as stocks, bonds, and inventory held for sale, aren’t eligible for a Section 1031 exchange.

- Multiple Properties: You have the option to identify up to three potential replacement properties, regardless of their value, or any number of properties as long as their combined value doesn’t exceed 200% of the value of the relinquished property.

Timing and Deadlines

Ensure that you’re aware of the specific timing and deadlines involved in a Section 1031 exchange to successfully navigate the process and maximize your tax benefits.

Timing is crucial in a 1031 exchange as there are strict deadlines that must be met. First, you must identify potential replacement properties within 45 days of selling your relinquished property. This identification must be done in writing and sent to a qualified intermediary. It’s important to note that weekends and holidays are included in this 45-day period. The identification must clearly state the address or legal description of the replacement property.

Additionally, there are two main deadlines to be aware of. The first is the 180-day deadline, which is the maximum timeframe you have to complete the exchange. This period starts on the closing date of the relinquished property. The second deadline is the 45-day deadline for acquiring the replacement property.

Both of these deadlines are strict and can’t be extended, so it’s crucial to carefully plan and execute your exchange within these timeframes to ensure a successful transaction.

Working With Qualified Intermediaries

When working with qualified intermediaries in a Section 1031 exchange, it’s important to choose a reputable and experienced professional to assist you throughout the process. A qualified intermediary plays a crucial role in facilitating the exchange and ensuring compliance with the tax code.

Here are some essential tips for working effectively with a qualified intermediary:

- Research and select a reliable intermediary: Look for a qualified intermediary with a proven track record and extensive experience in handling Section 1031 exchanges. Check their credentials and reputation in the industry.

- Ensure compliance with IRS regulations: A qualified intermediary must meet specific requirements set by the IRS. Make sure your chosen professional adheres to these regulations to avoid any potential pitfalls or disqualification of the exchange.

- Review the terms and fees: Carefully review the terms and fees associated with the intermediary’s services. Understand their fee structure, including any additional charges for services like document preparation or wire transfers.

- Maintain open communication: Establish clear lines of communication with your qualified intermediary. They should be readily available to answer your questions, provide guidance, and keep you informed throughout the exchange process.

- Seek professional advice: Although qualified intermediaries are experts in Section 1031 exchanges, it’s always advisable to consult with your tax advisor or attorney. They can provide additional guidance and ensure your overall tax planning and exit strategies align with your specific financial goals.

By working with a reputable qualified intermediary and following these tips, you can navigate the complexities of a Section 1031 exchange with confidence and maximize your tax benefits.

Now, let’s delve into the crucial topic of tax planning and exit strategies.

Tax Planning and Exit Strategies

To maximize your tax benefits, it’s essential that you carefully consider your tax planning and exit strategies in a Section 1031 exchange. Tax planning involves analyzing your financial situation and determining the most advantageous ways to minimize your tax liability. In the context of a Section 1031 exchange, this means understanding the rules and regulations surrounding the exchange and structuring your transaction in a way that complies with those requirements.

One important aspect of tax planning is timing. You need to consider when to initiate the exchange and how long it will take to complete. This is crucial because if you fail to meet the strict deadlines set by the IRS, you may lose your tax deferral benefits. Therefore, it’s vital to have a clear timeline and ensure that all the necessary steps are completed within the specified timeframes.

Exit strategies refer to your plans for disposing of the replacement property acquired through the 1031 exchange. You should carefully consider your long-term investment goals and evaluate whether holding onto the property or selling it would be more beneficial for you. It’s also essential to take into account any potential tax implications that may arise when you eventually sell the property.

Frequently Asked Questions

What Are the Potential Tax Consequences if I Fail to Meet the Timing and Deadlines for a Tax Code Section 1031 Exchange?

If you fail to meet the timing and deadlines for a tax code section 1031 exchange, you may face potential tax consequences. It is important to adhere to the rules and regulations to avoid any penalties or additional tax liabilities.

Can I Exchange My Primary Residence for Another Property Under Section 1031?

Yes, you can exchange your primary residence for another property under section 1031. However, there are specific requirements that must be met to qualify for tax deferral.

Are There Any Restrictions on the Types of Properties That Can Be Exchanged Under Section 1031?

Yes, there are restrictions on the types of properties that can be exchanged under section 1031. The IRS specifies that only real property, such as land and buildings, can be exchanged.

Can I Use a Family Member or a Friend as a Qualified Intermediary for My Section 1031 Exchange?

Yes, you can use a family member or a friend as a qualified intermediary for your Section 1031 exchange. However, it is important to ensure that they meet the requirements set by the IRS to avoid any potential issues.

What Happens if I Change My Mind During the Exchange Process and Decide Not to Complete the Transaction?

If you change your mind during the exchange process and decide not to complete the transaction, it could have tax consequences. It is important to consult with a tax professional to understand the potential implications.