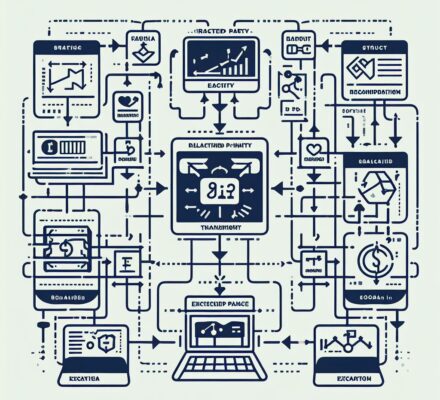

Are you looking to maximize tax benefits and streamline your property transactions? Consider the advantages of related party transactions in a 1031 exchange.

By utilizing this strategy, you can defer taxes, have more flexibility in selecting properties, and enjoy streamlined negotiations.

Additionally, you may find potential cost savings and strategic opportunities for estate planning.

Discover how related party transactions can give you an edge in optimizing your 1031 exchange.

Key Takeaways

- Tax Benefits and Deferral: Related party transactions in 1031 exchanges allow for the deferral of capital gains taxes until the related party sells the property, providing the opportunity to defer taxes indefinitely through successive exchanges. Additionally, the tax basis of the relinquished property can be transferred to the replacement property, and there is potential for a stepped-up basis upon the death of the related party.

- Flexibility in Transactions and Property Selection: Related party transactions offer flexibility in selecting properties and diversifying a portfolio. Property can be sold to a related party and another property of equal or greater value can be acquired, allowing for the reinvestment of proceeds without immediate tax obligations. This flexibility also extends to exchanging properties with family members or entities under common control, even if they are not like-kind.

- Streamlined Negotiations and Transactions: Engaging in a transaction with a related party streamlines negotiations and makes the process more efficient. Established relationships and trust eliminate the need for extensive negotiations and due diligence, reducing complexity, time, and costs associated with the exchange process. Dealing with familiar parties also reduces the risk of miscommunication or delays.

- Cost Savings: Related party transactions can result in significant cost savings. By bypassing real estate commissions and negotiating to split or eliminate certain closing costs, expenses can be reduced. Additionally, the streamlined negotiation process and potential for minimizing transaction costs and fees contribute to cost savings.

Tax Deferral Benefits

Enjoy the tax deferral benefits of related party transactions in a 1031 exchange by utilizing the strategy of ‘exchanging’ rather than ‘selling’ your property. By deferring the payment of capital gains taxes, you can maximize your investment potential and preserve your capital for future ventures.

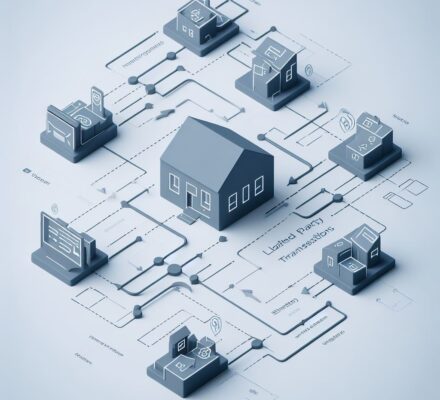

In a 1031 exchange, you can sell your property to a related party, such as a family member or a business partner, and acquire another property of equal or greater value. This allows you to defer the taxes that would normally be due upon the sale of the property. By reinvesting the proceeds into a new property, you can continue to grow your investment portfolio without the burden of immediate tax obligations.

One of the key advantages of related party transactions in a 1031 exchange is the flexibility it offers. You have the freedom to choose a property that best suits your investment goals and objectives. This allows you to strategically diversify your portfolio, potentially increasing your returns and minimizing your risks.

Additionally, related party transactions can provide you with the opportunity to consolidate your assets. By exchanging properties with a trusted party, you can streamline your real estate holdings and simplify your management responsibilities.

Flexibility in Property Selection

Maximize your investment potential and tailor your real estate portfolio to your specific goals and objectives by taking advantage of the flexibility in property selection offered by related party transactions in a 1031 exchange. When engaging in a 1031 exchange, you have the unique opportunity to exchange property with a related party, such as a family member or business partner. This opens up a range of possibilities for you to strategically select properties that align with your investment strategy.

Through related party transactions, you can consolidate your real estate holdings, acquire properties in different locations, or diversify your portfolio by investing in different property types. This flexibility allows you to optimize your investments and make strategic decisions based on market conditions and your investment goals.

To better understand the advantages of flexibility in property selection, let’s consider the following table:

| Property 1 | Property 2 |

|---|---|

| Location | Location |

| Property Type | Property Type |

| Rental Income | Rental Income |

| Potential Appreciation | Potential Appreciation |

| Long-term Growth Potential | Long-term Growth Potential |

By engaging in related party transactions, you can assess the characteristics of each property and choose the ones that align with your investment objectives. Whether you prioritize rental income, potential appreciation, or long-term growth potential, the flexibility in property selection allows you to curate a portfolio that suits your specific needs.

Streamlined Negotiations and Transactions

With related party transactions in a 1031 exchange, you can streamline negotiations and transactions, making the process more efficient and straightforward. By engaging in a transaction with a related party, such as a family member or a business associate, you have the advantage of already having an established relationship and a level of trust. This can eliminate the need for extensive negotiations and due diligence, as both parties are likely familiar with each other’s needs, preferences, and expectations.

Streamlined negotiations can help save time and reduce costs associated with the exchange process. Since you’re dealing with a related party, there’s a higher likelihood of reaching an agreement quickly and efficiently. This can be especially beneficial when time is of the essence, such as when you’re working against a strict deadline to complete the exchange.

Furthermore, related party transactions often involve fewer intermediaries, which can simplify the transaction process. With fewer parties involved, there’s less complexity and potential for miscommunication or delays. This can help ensure that the transaction proceeds smoothly and without unnecessary complications.

Potential for Cost Savings

You can achieve significant cost savings through related party transactions in a 1031 exchange. When engaging in a 1031 exchange, it’s common to work with related parties such as family members or entities under common ownership. These transactions offer a unique opportunity to save on costs that would otherwise be incurred in a traditional sale and purchase scenario.

One major cost-saving advantage of related party transactions is the potential to avoid real estate commissions. When buying or selling property through a real estate agent, you typically have to pay a commission fee, which can range from 5% to 6% of the property’s sale price. However, in a related party transaction, you can bypass this expense altogether by conducting the transaction directly with the related party.

Furthermore, related party transactions can also help you save on closing costs. In a traditional sale and purchase scenario, both the buyer and the seller are responsible for their respective closing costs, which can include fees for title searches, surveys, appraisals, and legal services. By working with a related party, you can negotiate to split or even eliminate certain closing costs, resulting in substantial savings.

In addition to these direct cost savings, related party transactions can also lead to indirect cost savings. For example, by working with a family member or a trusted entity, you can often streamline the negotiation process, reducing the time and effort required to reach an agreement. This efficiency can result in lower transaction costs, such as legal fees and other professional services.

It is important to note that while related party transactions can offer significant cost savings, they must be conducted in compliance with IRS regulations. The transactions must be conducted at fair market value and with a genuine intent to hold the property for investment or business purposes. Failure to adhere to these guidelines can result in the disqualification of the 1031 exchange and potential tax consequences.

Strategic Estate Planning Opportunities

One key opportunity in related party transactions within a 1031 exchange is the ability to strategically plan your estate. This allows you to not only defer taxes on your property sale but also create a long-term estate plan that aligns with your goals.

Here are three ways related party transactions can provide strategic estate planning opportunities:

- Consolidate and diversify: By exchanging your property with a related party, you can consolidate your real estate holdings into properties that better suit your estate plan. This allows you to diversify your portfolio and potentially reduce risk.

- Transfer wealth: Related party transactions can be a useful tool for transferring wealth to your heirs. By strategically exchanging properties with family members or trusts, you can ensure a smooth and tax-efficient transfer of assets, while also minimizing potential estate taxes.

- Estate liquidity: Related party transactions can also provide estate liquidity. By exchanging a property with a related party, you can convert illiquid assets into cash or more liquid investments. This can be particularly helpful if you need funds to cover estate taxes or other expenses.

Frequently Asked Questions

Can Related Party Transactions in a 1031 Exchange Be Used to Defer Taxes Indefinitely?

Yes, related party transactions in a 1031 exchange can be used to defer taxes indefinitely. However, it is important to consult with a tax professional to ensure compliance with IRS regulations.

Are There Any Restrictions on the Types of Properties That Can Be Exchanged in a Related Party Transaction?

There are no specific restrictions on the types of properties that can be exchanged in a related party transaction. However, it is important to ensure that the transaction is conducted at fair market value to avoid any potential tax issues.

How Do Related Party Transactions in a 1031 Exchange Simplify the Negotiation and Transaction Process?

Related party transactions in a 1031 exchange simplify negotiation and transaction processes by allowing you to work with someone you already have a relationship with. This can streamline communication and potentially expedite the transaction.

What Are Some Potential Cost Savings That Can Be Achieved Through Related Party Transactions in a 1031 Exchange?

Some potential cost savings that can be achieved through related party transactions in a 1031 exchange include reduced transaction fees, lower tax liabilities, and the ability to negotiate more favorable terms with a familiar party.

How Can Related Party Transactions in a 1031 Exchange Be Utilized as Part of a Strategic Estate Planning Strategy?

As part of a strategic estate planning strategy, you can utilize related party transactions in a 1031 exchange to transfer property to family members, while still deferring capital gains taxes.