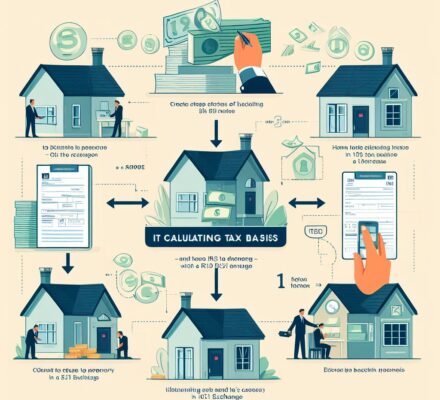

Are you ready to master the art of accurate tax basis in a 1031 exchange? Look no further!

In this article, we will reveal the three best strategies that will take your tax basis game to the next level.

First, conducting thorough property appraisals is essential. This will help you determine the fair market value of your property and establish a solid tax basis. Make sure to hire a qualified appraiser who is experienced in 1031 exchanges to ensure accuracy.

Second, keeping detailed records of property improvements is crucial. Any improvements you make to the property can be added to your tax basis, reducing your potential capital gains tax liability. Keep track of all expenses related to improvements, including materials, labor, and permits.

Lastly, consulting with a tax professional for expert guidance is highly recommended. Tax laws can be complex, and having a knowledgeable professional on your side can help you navigate the intricacies of tax basis calculations and ensure compliance with IRS regulations.

By following these strategies and implementing them in your 1031 exchange transactions, you’ll be a pro at maximizing your tax benefits in no time.

Key Takeaways

- Thorough property appraisals determine the fair market value of the property.

- Keeping detailed records of property improvements helps calculate cost basis and potential depreciation deductions.

- Consulting with a tax professional provides in-depth knowledge and guidance on tax basis calculations.

- Incorrect tax basis can lead to penalties, additional tax liabilities, and problems with the IRS.

Conduct Thorough Property Appraisals

To ensure accurate tax basis in your 1031 exchange, conduct a thorough property appraisal. An appraisal is a critical step in determining the fair market value of your property. It provides an objective assessment of its worth, which is essential for calculating the correct tax basis. By hiring a professional appraiser, you can ensure that the valuation is done accurately and in compliance with the IRS guidelines.

During the appraisal process, the appraiser will consider various factors such as the property’s location, condition, size, and comparable sales in the area. They’ll gather relevant data and analyze it to determine the property’s fair market value. This value will serve as the starting point for calculating your tax basis in the 1031 exchange.

A thorough property appraisal is crucial because an incorrect tax basis can lead to potential problems with the IRS. If the tax basis is overestimated, you may end up paying more taxes than required. On the other hand, underestimating the tax basis can result in penalties and additional tax liabilities. By conducting a comprehensive appraisal, you can avoid these issues and ensure that your tax basis is accurate.

Keep Detailed Records of Property Improvements

To accurately track the tax basis in your 1031 exchange, you should keep detailed records of any property improvements. These records are crucial for accurately calculating your cost basis and potential depreciation deductions. When you make improvements to your property, such as renovations or additions, it’s essential to document the costs associated with these enhancements. This includes keeping receipts, invoices, and any other relevant paperwork.

By maintaining detailed records, you can provide evidence to the Internal Revenue Service (IRS) of the expenses incurred for the improvements. This documentation will help support your claim for depreciation deductions and ensure compliance with tax regulations.

In addition to cost documentation, it’s advisable to keep records of the scope and nature of the improvements. This information can be useful when determining the adjusted basis of your property and calculating depreciation deductions over time. Furthermore, if you decide to sell the property in the future, these records will be invaluable for accurately reporting the gain or loss on your tax return.

Consult With a Tax Professional for Guidance

Consider consulting with a tax professional for expert guidance on navigating your 1031 exchange and ensuring accurate tax basis calculations. While it may seem tempting to handle the process on your own, the complexities of tax laws and regulations can easily lead to errors that may result in costly penalties or missed opportunities. A tax professional can provide valuable insights and advice tailored to your specific situation, ensuring that you make well-informed decisions and maximize your tax benefits.

Here are some reasons why consulting with a tax professional is crucial during a 1031 exchange:

| Reasons to Consult with a Tax Professional | Benefits |

|---|---|

| In-depth knowledge of tax laws and regulations | Ensures compliance and minimizes the risk of costly mistakes |

| Ability to analyze your financial situation | Helps determine the most advantageous tax strategies |

| Experience in handling 1031 exchanges | Provides guidance based on real-world expertise |

| Access to resources and tools | Assists in accurate tax basis calculations and documentation |

Frequently Asked Questions

What Are the Potential Tax Consequences of Not Conducting Thorough Property Appraisals in a 1031 Exchange?

Not conducting thorough property appraisals in a 1031 exchange can lead to potential tax consequences. It’s important to accurately determine the tax basis to avoid underreporting or overreporting gains, which could result in penalties or audits.

Can I Include Property Improvements Made Prior to the Acquisition Date in My Tax Basis Calculation?

Yes, you can include property improvements made prior to the acquisition date in your tax basis calculation. This allows you to accurately reflect the total amount you have invested in the property for tax purposes.

Are There Any Specific Guidelines or Requirements for Keeping Detailed Records of Property Improvements in a 1031 Exchange?

To accurately calculate your tax basis in a 1031 exchange, it is important to keep detailed records of property improvements. Specific guidelines and requirements may vary, so consult with a tax professional for the best strategies.

How Can a Tax Professional Assist Me in Accurately Determining My Tax Basis in a 1031 Exchange?

A tax professional can assist you in accurately determining your tax basis in a 1031 exchange. They have the expertise to navigate the complex rules and guidelines, ensuring you don’t miss out on any deductions or make costly mistakes.

Are There Any Common Mistakes or Pitfalls to Avoid When Consulting With a Tax Professional for Guidance in a 1031 Exchange?

When consulting with a tax professional for guidance in a 1031 exchange, be aware of common mistakes or pitfalls. Ensure they have expertise in this area and are familiar with the specific rules and regulations to avoid potential errors.