Imagine if you could unlock a treasure trove of tax savings by strategically determining the basis for your 1031 exchanges. Well, you can!

In this article, we will delve into the importance of tax basis determination. We will explore the factors that influence tax basis calculation, discuss various methods for determining tax basis, and reveal effective strategies for maximizing your tax savings.

Get ready to navigate the complex world of tax planning with precision and confidence.

Key Takeaways

- Tax basis determination is crucial for understanding the importance of 1031 exchanges.

- Accurately determining the tax basis allows for compliance with IRS regulations and calculation of capital gains tax.

- Factors such as original cost basis, capital improvements, depreciation, and taxable events affect the tax basis calculation.

- Strategies for maximizing tax savings in 1031 exchanges include identifying replacement properties with higher potential, utilizing cost segregation studies, considering partial exchanges, and consulting with a tax professional.

Importance of Tax Basis Determination

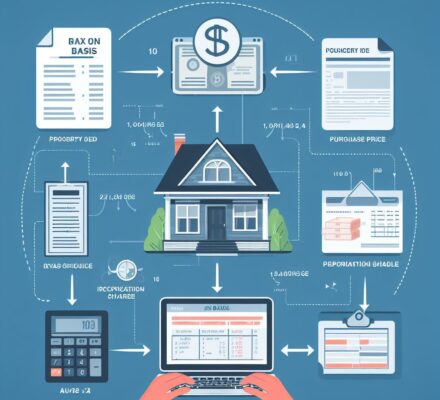

Determining the tax basis is crucial when it comes to understanding the importance of 1031 exchanges. The tax basis refers to the value of an asset for tax purposes, and it plays a significant role in determining the tax consequences of a 1031 exchange.

When you engage in a 1031 exchange, you’re deferring the capital gains tax on the sale of an investment property by reinvesting the proceeds into a like-kind property. The tax basis of the property you acquire is determined by subtracting the deferred gain from the tax basis of the property you sold.

By accurately determining the tax basis, you can ensure that you comply with the Internal Revenue Service (IRS) regulations and maximize the tax benefits of a 1031 exchange. It allows you to calculate the capital gains tax that would have been due if you hadn’t engaged in the exchange. This information is vital for making informed investment decisions and evaluating the financial feasibility of a 1031 exchange.

Factors affecting tax basis calculation include the original purchase price of the property, any improvements made to the property, depreciation deductions, and any taxable events that occurred during the ownership period. By understanding these factors and accurately calculating the tax basis, you can make strategic decisions that minimize your tax liability and optimize the potential benefits of a 1031 exchange.

Factors Affecting Tax Basis Calculation

To accurately calculate the tax basis for a 1031 exchange, you need to consider several factors that impact the calculation. These factors play a crucial role in determining the amount of taxable gain or loss and can significantly affect your financial outcome.

Here are three key factors to consider:

- Original Cost Basis: The original cost basis is the initial purchase price of the property. This includes not only the purchase price but also any additional costs incurred during the acquisition, such as closing costs, legal fees, and brokerage commissions. It’s important to accurately determine the original cost basis as any errors can lead to incorrect tax calculations.

- Capital Improvements: Any capital improvements made to the property during your ownership period can be added to the tax basis. These improvements can include renovations, additions, or significant repairs that enhance the property’s value. Including these costs in your tax basis can help minimize your taxable gain.

- Depreciation: Depreciation is the gradual decrease in the value of the property over time. It allows you to deduct a portion of the property’s value each year for tax purposes. However, depreciation reduces your tax basis, so it’s important to account for it when calculating the tax basis for your 1031 exchange.

Methods for Determining Tax Basis

To determine the tax basis for a 1031 exchange, you can utilize various methods. These methods are designed to help you accurately calculate the basis of the property involved in the exchange, ensuring compliance with tax regulations. Here are three common methods used for determining tax basis:

| Method | Description |

|---|---|

| Cost Basis | This method involves determining the original cost of the property, including the purchase price and any related expenses such as closing costs and legal fees. It is the most straightforward method and is often used when the property has been recently acquired. |

| Adjusted Basis | The adjusted basis method takes into account any adjustments made to the original cost basis during the ownership period. These adjustments can include capital improvements, depreciation, and casualty losses. This method provides a more accurate reflection of the property’s value at the time of the exchange. |

| Appraisal | If the property has been held for a long time or if there are complex factors affecting its value, an independent appraisal may be necessary. This method involves hiring a professional appraiser to determine the fair market value of the property. The appraised value is then used as the tax basis for the exchange. |

Strategies for Maximizing Tax Savings

Implement strategies to maximize your tax savings during a 1031 exchange. By carefully planning and executing your exchange, you can significantly reduce your tax liability and retain more funds for reinvestment.

Here are three key strategies to consider:

- Identify the right replacement property: Choose a property with a higher potential for appreciation or income generation. By selecting a property with strong growth prospects, you can increase your future returns and potentially offset any tax liability.

- Leverage cost segregation: Utilize cost segregation studies to allocate the purchase price of the replacement property into different asset classes. This allows you to accelerate depreciation deductions, resulting in larger tax savings in the early years of ownership.

- Consider partial exchanges: If you have additional funds available, you can consider a partial exchange. By reinvesting only a portion of the proceeds from the sale of your relinquished property, you can retain some cash while still enjoying the tax advantages of a 1031 exchange.

Considerations for Future Tax Planning

Consider consulting with a tax professional to develop a comprehensive plan for future tax planning in your 1031 exchange. This is an important step to ensure that you’re maximizing your tax savings and taking advantage of all available strategies. A tax professional can help you determine the best course of action based on your specific financial goals and circumstances.

One consideration for future tax planning is the timing of your 1031 exchanges. By strategically planning the timing of your exchanges, you can potentially minimize your tax liability. For example, if you anticipate a significant increase in your future tax bracket, it may be advantageous to complete your exchanges before that increase takes effect.

Another consideration is the selection of replacement properties. By carefully choosing properties with potential for future appreciation, you can potentially benefit from increased tax savings in the long run. Additionally, you should consider the location and market conditions of potential replacement properties, as these factors can also impact your tax savings.

Furthermore, it’s important to stay informed about changes in tax laws and regulations. Tax laws are subject to change, and staying up-to-date can help you make informed decisions and adapt your tax planning strategy accordingly.

Frequently Asked Questions

What Are the Potential Risks or Consequences of Incorrectly Determining Tax Basis for a 1031 Exchange?

Incorrectly determining tax basis for a 1031 exchange can lead to potential risks and consequences. This might include underpayment of taxes, penalties, and scrutiny from the IRS. It is crucial to accurately calculate and document your tax basis to avoid these issues.

How Does Depreciation Recapture Impact the Tax Basis Calculation for a Property Involved in a 1031 Exchange?

Depreciation recapture affects the tax basis calculation for a property in a 1031 exchange. It’s important to consider the recaptured depreciation when determining the basis, as it could have tax implications for the exchange.

Are There Any Special Rules or Considerations for Determining Tax Basis When Multiple Properties Are Involved in a 1031 Exchange?

When multiple properties are involved in a 1031 exchange, special rules and considerations apply to determine the tax basis. These rules aim to ensure accurate calculation and compliance with the IRS regulations.

Can the Tax Basis Be Adjusted After the Completion of a 1031 Exchange, and if So, Under What Circumstances?

Yes, the tax basis can be adjusted after completing a 1031 exchange, but only under specific circumstances. These circumstances include errors in the original basis determination or changes in the property’s value due to events after the exchange.

Are There Any Specific IRS Guidelines or Regulations That Need to Be Followed When Determining Tax Basis for a 1031 Exchange?

You may be wondering about the specific IRS guidelines or regulations that need to be followed when determining tax basis for a 1031 exchange. Well, let me explain the requirements in detail.