Are you ready to navigate the complex world of tax basis calculations for a 1031 exchange? Look no further!

This step-by-step guide will be your trusted companion as you embark on this financial journey. With our knowledgeable and thorough approach, we will help you understand the ins and outs of identifying adjustments, calculating depreciation, and factoring in improvements.

Get ready to take control of your tax basis and make informed decisions.

Let’s dive in and conquer the world of 1031 exchanges together!

Key Takeaways

- Tax basis refers to the original cost of the property plus additional expenses incurred during ownership.

- Adjustments and additions, such as capital improvements and closing costs, impact tax basis and should be documented.

- Depreciation should be calculated to determine the adjusted tax basis for a 1031 exchange.

- Improvements and capital expenses should be factored in by adding their cost to the original purchase price to determine the adjusted tax basis.

Understanding Tax Basis

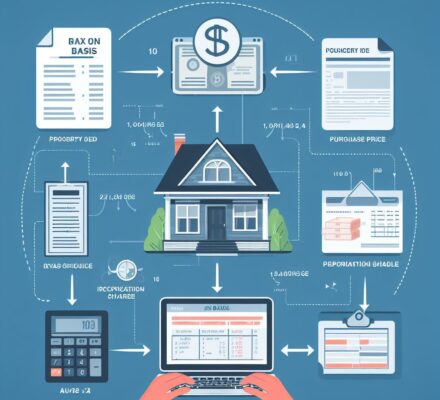

Understanding tax basis is essential when considering a 1031 exchange for your property. It refers to the original cost of your property plus any additional expenses incurred during the ownership period. To calculate your tax basis, you need to consider the purchase price, closing costs, and any capital improvements made. This information is crucial because it determines the amount of taxable gain or loss you have when you sell your property.

The tax basis is used to calculate the capital gains tax you owe. If the sale price of your property is higher than the tax basis, you’ll have a taxable gain. On the other hand, if the sale price is lower than the tax basis, you’ll have a taxable loss. Understanding your tax basis is vital when considering a 1031 exchange because it impacts the amount of tax you’ll owe on the replacement property.

To ensure accurate calculations, it’s advisable to keep detailed records of all expenses related to your property. These records will help you accurately determine your tax basis and minimize potential errors or discrepancies when filing your taxes. Additionally, consulting with a tax professional who’s knowledgeable about 1031 exchanges can provide valuable guidance and ensure compliance with tax laws.

Identifying Adjustments and Additions

To calculate your tax basis for a 1031 exchange, you need to identify any adjustments and additions made to the original cost of your property. These adjustments and additions can significantly impact your tax liability and should be carefully considered. Here are some common adjustments and additions to be aware of:

| Adjustments | Additions | Examples |

|---|---|---|

| Capital improvements | Closing costs | Installing a new roof, upgrading the electrical system |

| Depreciation deductions | Assumption of debt | Writing off the cost of the property over time |

| Insurance reimbursements | Assessments | Receiving compensation for property damage |

| Repairs and maintenance | Special assessments | Fixing a leaky faucet, repainting a room |

| Property taxes paid | Improvement costs | Paying taxes on the property to local authorities |

These adjustments and additions should be carefully documented and accounted for when calculating your tax basis. It is important to consult with a tax professional or CPA to ensure that you accurately calculate your tax liability and take advantage of any available deductions or credits. By properly identifying and accounting for adjustments and additions, you can maximize the benefits of a 1031 exchange and minimize your tax burden.

Calculating Depreciation

Start by determining the amount of depreciation that has been taken on the property. Depreciation is the reduction in value of an asset over time due to wear and tear, obsolescence, or other factors. It’s an important factor to consider when calculating the tax basis for a 1031 exchange. Here’s how to calculate depreciation:

- Gather depreciation records: Collect all relevant documents, such as tax returns and depreciation schedules, to determine the total amount of depreciation that has been taken on the property.

- Calculate annual depreciation: Determine the annual depreciation expense by dividing the total depreciation taken over the property’s life by the number of years it has been owned.

- Adjust for partial year: If the property was acquired or disposed of during the year, prorate the annual depreciation based on the number of days it was owned.

By calculating the depreciation taken on the property, you can accurately determine the adjusted tax basis for your 1031 exchange. This information is crucial for determining the taxable gain or loss and the amount of tax you may owe.

Now, let’s move on to the next step: factoring in improvements and capital expenses.

Factoring in Improvements and Capital Expenses

To factor in improvements and capital expenses, you’ll need to consider the costs associated with enhancing the property and any significant investments made during its ownership. Improvements refer to any changes or additions that increase the value of the property, such as renovations, additions, or upgrades. These expenses can be added to the tax basis of the property and can help reduce the capital gains tax owed when conducting a 1031 exchange.

When calculating the tax basis, it’s important to keep detailed records of all improvements and capital expenses incurred. This includes invoices, receipts, and any other relevant documentation. The IRS requires that improvements must have a useful life of more than one year and be intended to prolong the property’s life or adapt it to a different use.

To determine the tax basis, you’ll need to add the cost of the improvements and capital expenses to the original purchase price of the property. This adjusted tax basis will be used to calculate the capital gains or losses during the 1031 exchange. It’s important to note that not all expenses can be included in the tax basis calculation, such as routine repairs and maintenance costs.

Determining the Adjusted Tax Basis

First, calculate the adjusted tax basis by adding the cost of improvements and capital expenses to the original purchase price of the property. This step is crucial in determining the taxable gain or loss on your 1031 exchange.

Here is a step-by-step guide to help you determine the adjusted tax basis:

- Gather all records: Collect all relevant documents, such as receipts and invoices, for any improvements or capital expenses made on the property since its purchase.

- Identify eligible expenses: Review the records and identify the expenses that qualify as improvements or capital expenses. These can include renovations, additions, and major repairs that enhance the property’s value or extend its useful life.

- Calculate the total cost: Add up the costs of all eligible improvements and capital expenses. This total will be added to the original purchase price to determine the adjusted tax basis.

Frequently Asked Questions

How Does the Length of Time I Have Owned a Property Affect the Tax Basis Calculation for a 1031 Exchange?

The length of time you have owned a property affects the tax basis calculation for a 1031 exchange. The longer you have owned the property, the higher the tax basis, potentially resulting in lower taxes owed.

Can I Include the Cost of Repairs and Maintenance in the Tax Basis Calculation?

Yes, you can include the cost of repairs and maintenance in the tax basis calculation for a 1031 exchange. This allows you to offset any gains and potentially reduce your tax liability.

Are There Any Specific Rules or Limitations When It Comes to Calculating the Tax Basis for Real Estate Used for Rental Purposes?

When calculating the tax basis for rental real estate, there are specific rules and limitations to consider. These include factors such as depreciation, improvements, and repairs. It’s important to consult with a tax professional to ensure accuracy.

How Do I Account for Any Outstanding Mortgage or Loans on the Property When Determining the Adjusted Tax Basis?

When determining the adjusted tax basis for a property with outstanding mortgage or loans, you subtract the amount of these debts from the original purchase price. This gives you the adjusted tax basis for your 1031 exchange.

What Happens if I Cannot Determine the Original Cost or Fair Market Value of a Property When Calculating the Tax Basis for a 1031 Exchange?

If you cannot determine the original cost or fair market value of a property when calculating the tax basis for a 1031 exchange, you may need to consult with a tax professional for guidance and to ensure compliance with IRS regulations.