Turning a profit on your investments requires you to understand how to balance the potential rewards and risks. For one, calculating a property’s capitalization rate can provide you with a rough estimate of how much you can expect in returns at any time.

The internal rate of return (IRR) provides a measurement of a real estate long-term asset’s yield. This metric is vital, and all real estate investors can benefit from understanding it.

What is Real Estate Investing?

Real estate investing refers to buying or selling buildings and land to generate revenue. There are a few different categories to consider in real estate investing. The categories are broadly grouped as follows:

Residential Real Estate

This category focuses on vacation properties, apartment buildings, and multifamily complexes. It is generally the easiest real estate investment opportunity for a beginner to get into. When you pay off the mortgage on a rental property, any rental income becomes passive income.

Commercial Real Estate

Commercial real estate (CRE) involves retail storefronts, office spaces, or any building used for business purposes. Entering commercial real estate is a lot more expensive than the residential category as you will have to manage more property.

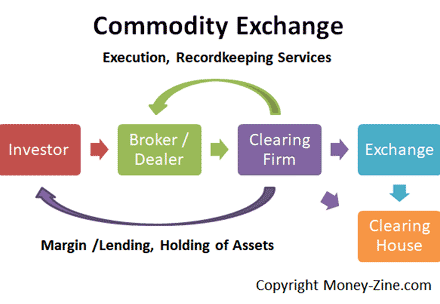

The most effective way for an individual investor to enter the CRE industry is to buy shares in a real estate investment trust (REIT).

Industrial Real Estate

Industrial real estate is the category that includes storage units, warehouses, and any other large purpose-built structures that generate revenue.

What is IRR?

Internal rate of return (IRR) is a metric typically financial analysts use to assess the profitability of a potential investment.

Generally, a higher internal rate of return means a more attractive investment. You can use IRR for just about any type of investment, and it is for this reason that people use it to rank various projects or investments on a seemingly even basis.

When comparing real estate investment opportunities with similar characteristics, it is always best to go with the one that has a higher internal rate of return.

Understanding IRR

The primary goal of the internal rate of return is identifying the discount rate of the current value of total yearly cash inflows and the initial cash investment. There are various ways to find an investment’s expected return. However, people see the IRR as the perfect metric to analyze a new project’s prospective return.

Consider IRR the growth rate you can expect from an investment every year, making it a lot more similar to the compound annual growth rate or CAGR. That said, an investment is unlikely to have an identical return year-on-year. Typically, the actual return rate is different from the estimated IRR.

For example, if you are trying to choose whether to build a new apartment complex or renovate the one you already own, you can use IRR to decide which investment provides a higher return. While the two projects can increase your investment portfolio’s value, the one that makes the most sense is highlighted by IRR.

How is IRR Used in Real Estate Investments?

Although IRR can provide useful information about a property, completely relying on it can have some drawbacks when comparing investments in real estate. There is some guesswork involved in calculating the IRR, especially since you make assumptions about the potential cash flow potential of the property. You are also guessing how the market will fare overall.

If any surprises crop up or you can’t sustain the rental income estimated at the beginning of the project, the initial IRR calculation may become useless.

For this reason, when using IRR to appraise various investment opportunities, it is important to keep this in context. The most effective way to compare is by choosing properties with a comparative amount of risks and timelines, ensuring you don’t make any mistakes when choosing the right investment.

When to Use IRR

Investments

IRR can be used to analyze investment returns. Most of the time, the projected return considers any cash dividends or interest payments that are reinvested. But what if an investor has no interest in reinvesting the dividends and prefers an annual cash flow? What is the presumed return on cash?

Lastly, IRR is a metric you can use to calculate the money-weighted rate of return (MWRR) of an investment. The MWRR assists in determining the required rate of return with a particular investment amount. It also accounts for all the changes in cash flows throughout investment performance.

Insurance

IRR can also be used by individuals to make financial decisions. An example is when an investor wants to evaluate different property insurance policies. If these policies come with equal premiums, the one with a high IRR is a lot more desirable. Insurance usually has a high IRR in the first few years of the policy, but it goes down over time.

What Limitations Does IRR Have?

When used outside the right scenarios, IRR can be misinterpreted or misconstrued. If a timeline has negative cash flows and then positive ones and then negative ones again, the IRR might have various values. Plus, if the investment project never yields any profit, there is no NPV with the discount rate.

When used in appropriate circumstances, IRR is a popular metric to estimate the yearly return of a project. Nevertheless, you don’t want to use it in isolation. There is a pretty high value with IRR, enabling it to have an NPV of 0. IRR is the sole estimated figure providing a yearly return based on estimates. Since the estimated NPV and IRR can differ from real-life results, many analysts combine scenario analysis with IRR analysis.

As stated earlier, most investors and companies don’t rely on NPV and IRR analysis alone. These calculations can be used with other metrics to get a clearer picture of a project. Organizations usually use IRR analysis to compare tradeoffs. For instance, if there is another investment project with a similar IRR but less upfront capital requirement, then they might choose the simpler investment, regardless of IRR.

Sometimes, problems can also arise using IRR when comparing two projects of different lengths. For instance, a short-term project might have a higher IRR, making it appear like a great investment. On the other hand, the longer project might have a low IRR and earn returns slowly but steadily. The return on investment metric is used to provide clarity in either of these cases. However, some investors might not want the longer timeframe.

How IRR Differs From Other Metrics

How Does IRR Differ from Compound Annual Growth Rate?

CAGR is the annual return over time, and while the IRR can also be a yearly rate of return, the CAGR generally only uses the start and end value to give you an estimated yearly return rate.

IRR tends to differ as it accounts for various cash flows over time, reflecting the cash outflows and inflows that constantly occur with the investment. Another difference is that you can easily calculate CAGR.

How IRR differs from Return on Investment

Companies and investors might also consider an investment’s return rate when making decisions about capital budgeting. This metric provides information about an investment’s total growth and cannot be quantified as the yearly rate of return.

On the other hand, IRR informs the investor about the annual growth rate. Both numbers are normally the same over a year. However, they begin to differ once the timeline gets longer.

ROI is the decrease or increase of an investment covering the start to the end. To calculate it, subtract the starting value from the expected or current value. Then, divide it by the original value and multiply it by 100.

Almost any investment vehicle that requires an outcome can use the ROI figure. However, ROI isn’t the most effective metric with extended timelines. There are also capital budgeting limitations, where the focus is usually on periodic cash flows and total return.

Conclusion

Understandably, all of this may sound a bit confusing to you, especially if you are making a first-time investment decision. If that’s the case, it is best to work with a financial advisor to ensure you get the most out of your initial investment. A financial advisor can streamline the process by using their expertise to help you understand the best investment property based on its IRR.