From the outside, a 1031 exchange can seem like a daunting proposition. A transaction that involves multiple real estate transfers, arcane tax codes, and a team of lawyers and accountants? For most people, that's the equivalent of a flashing neon sign saying, "Count me out."

With the right preparation and the right support, however, 1031 tax exchanges don't have to be anywhere near that level of doom and gloom. In truth, a 1031 exchange can be a simple transaction that requires only the most basic of information to get started.

You'll begin with an information-gathering phase. At this early stage, you want to learn as much as possible about 1031 tax exchanges and how they can affect you. Reading this information is a great place to start – but you should research widely to make sure you are well read on the subject. Next, you should consult with your personal tax advisor. This individual can help you look at the pros and cons of a 1031 tax exchange within the context of your own personal situation. This tax professional can help you look closely at your specific situation: is the exchange practical based on an estimation of capital gains?

1031 Tax Exchange Instructions

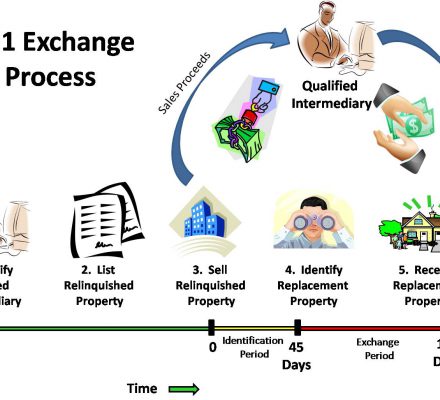

Once you're sure you want to proceed with the 1031 tax exchange, complete the sale of your current property and take the signed agreements to the closing agent to open escrow. Inform the closing agent that your intention is to complete a 1031 exchange, then contact the party who is assisting you with your 1031 exchange so that all the relevant information can be traded. The company or individual assisting you with your 1031 tax exchange will then correspond with the closing agent to manage a number of details – allowing you to sign the relevant exchange documents when you sign other closing documents. The closing agent will then transfer proceeds from the sale of your property to your 1031 exchange manager. Your 45- and 180-day clocks now begin to tick.

Within 45 days of this date, you must legally identify the replacement property you wish to purchase. You will then enter the purchasing process on this new property. Sale and purchase agreements for this transaction must include an "Exchange Clause" explaining that the transaction is part of a 1031 exchange so that all parties are clear on the rules and stipulations therein. Your qualified intermediary will then contact the closing agent to handle the relevant paperwork and move the procedure into escrow. The proceeds from the sale of your previous property are then paid out by your qualified intermediary to the necessary party. Note that at the end of your 180-day exchange period, any unused funds from your initial sale are returned to you as the "boot" – and are subject to taxation.