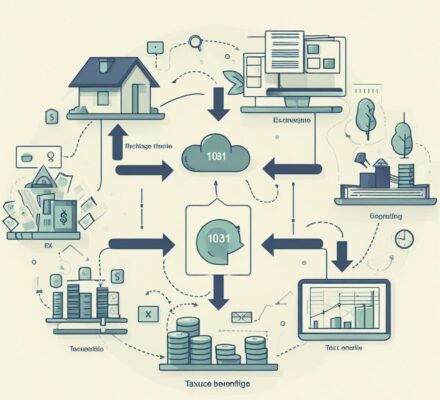

Looking to maximize your tax savings? Consider exploring the tax advantages of a 1031 exchange.

By utilizing this powerful strategy, you can defer capital gains taxes on the sale of your investment property and reinvest the proceeds into a like-kind property.

Discover how this exchange can provide you with significant tax benefits while allowing you to grow your real estate portfolio. However, beware of potential pitfalls and eligibility requirements.

Let’s dive in and uncover the ins and outs of a 1031 exchange.

Key Takeaways

- A 1031 exchange allows for the tax-deferred exchange of one investment property for another.

- By utilizing a 1031 exchange, capital gains taxes can be postponed, resulting in increased cash flow and potential wealth accumulation.

- Eligible properties must be held for productive use in business, trade, or investment purposes and must be of like-kind.

- Strategies for maximizing tax savings through a 1031 exchange include diversifying the real estate portfolio, upgrading to properties with higher potential, and utilizing properties with significant depreciation potential.

What Is a 1031 Exchange

A 1031 exchange is a tax-deferred transaction that allows you to exchange one investment property for another. This type of exchange is named after Section 1031 of the Internal Revenue Code, which provides the guidelines for this tax-saving strategy. It allows you to defer paying capital gains taxes on the sale of a property if you reinvest the proceeds into a like-kind property. By doing so, you can potentially save a significant amount of money that would have otherwise gone towards taxes.

The key benefit of a 1031 exchange is the ability to defer taxes. When you sell an investment property, you’d typically be subject to capital gains taxes on the profit you make from the sale. However, with a 1031 exchange, you can defer paying those taxes by reinvesting the proceeds into another qualifying property. This allows you to keep more money working for you in the real estate market, rather than paying it to the government in taxes.

It’s important to note that a 1031 exchange is only available for investment or business properties. You can’t use this strategy for personal residences. Additionally, the properties involved in the exchange must be of like-kind, meaning they’re similar in nature or use. This gives you the flexibility to exchange different types of real estate, such as residential properties for commercial properties, or vacant land for rental properties.

In order to qualify for a 1031 exchange, there are strict rules and timelines that must be followed. The exchange must be completed within a certain timeframe, typically 180 days, and you must identify potential replacement properties within 45 days of selling your original property. It’s crucial to work with a qualified intermediary who can guide you through the process and ensure you meet all the necessary requirements.

The Tax Deferral Benefits of a 1031 Exchange

To fully understand the tax advantages of a 1031 exchange, it is important for you to grasp the primary benefit: the deferral of capital gains taxes. A 1031 exchange allows you to defer paying capital gains taxes on the sale of an investment property if you reinvest the proceeds into a like-kind property within a certain timeframe. This can result in significant tax savings and provide you with more capital to invest in a new property.

Let’s take a closer look at the tax deferral benefits of a 1031 exchange:

| Tax Deferral Benefits | Explanation |

|---|---|

| Deferred Taxes | By utilizing a 1031 exchange, you can postpone paying capital gains taxes, allowing you to keep more money invested and working for you. |

| Increased Cash Flow | The tax deferral can result in increased cash flow as you are not using that money to pay taxes, giving you more funds to reinvest or use as you see fit. |

| Compound Growth | The ability to defer taxes allows your investment to grow and compound over time, potentially resulting in significant wealth accumulation. |

| Portfolio Diversification | A 1031 exchange allows you to sell one property and acquire multiple properties, helping you diversify your investment portfolio. |

| Estate Planning | By deferring taxes through a 1031 exchange, you can pass on a larger estate to your heirs, potentially minimizing their tax burden. |

Eligibility Requirements for a 1031 Exchange

To qualify for a 1031 exchange, you must meet certain eligibility requirements.

The first requirement is that the property you’re selling and the property you’re acquiring must both be held for productive use in business, trade, or investment purposes. This means that you can’t use the properties for personal purposes such as a primary residence or vacation home.

Another requirement is that the properties involved in the exchange must be like-kind, meaning they’re of the same nature or character. For example, you can exchange a commercial property for another commercial property, but not for a residential property.

Additionally, the exchange must be completed within a specific time frame. You have 45 days from the date of selling your property to identify potential replacement properties, and you must close on the replacement property within 180 days.

It’s important to note that the 1031 exchange isn’t available for all types of properties, such as stocks, bonds, and partnership interests.

Strategies for Maximizing Tax Savings Through a 1031 Exchange

To maximize your tax savings through a 1031 exchange, consider implementing strategic approaches. Here are some strategies that can help you make the most of this tax-advantaged opportunity:

- Diversify your portfolio: Use the 1031 exchange to expand your real estate holdings and diversify your investments. By exchanging into different types of properties or in different locations, you can spread your risk and potentially increase your long-term returns.

- Upgrade your property: Consider exchanging into a property that has the potential for higher rental income or greater appreciation. By upgrading your property, you can increase your cash flow and potentially build more equity over time.

- Time your exchanges: Pay attention to market trends and timing to maximize your tax savings. If you believe that property values are likely to increase in the future, it may be advantageous to exchange into a property with higher growth potential.

- Leverage the power of depreciation: Take advantage of the tax benefits of depreciation by exchanging into properties that have significant depreciation potential. Depreciation allows you to offset rental income and reduce your taxable income.

- Consult with a tax professional: The rules and regulations surrounding a 1031 exchange can be complex. Working with a knowledgeable tax professional can help you navigate the process and ensure you’re fully maximizing your tax savings.

Potential Pitfalls and Limitations of a 1031 Exchange

Navigating a 1031 exchange comes with potential pitfalls and limitations that you should be aware of. While this tax strategy offers numerous benefits, it is crucial to understand its limitations to avoid any unexpected surprises. Here are some key considerations to keep in mind:

| Potential Pitfalls | Limitations |

|---|---|

| Strict time constraints | Like-kind requirement |

| Property identification | Depreciation recapture |

| Financial risk | Limited flexibility |

One of the main challenges of a 1031 exchange is the strict time constraints involved. From the date of the sale of your relinquished property, you have 45 days to identify up to three potential replacement properties and a total of 180 days to close on one of them. This timeline can be quite demanding, and it is crucial to work with experienced professionals who can help you meet these deadlines.

Another limitation of a 1031 exchange is the requirement for like-kind properties. To qualify, the property you sell and the property you acquire must be of the same nature or character. For example, you cannot exchange a residential property for a piece of land or a commercial building. This restriction limits your options and may require careful planning to find suitable replacement properties.

Additionally, a 1031 exchange does not eliminate your tax obligations entirely. While you can defer your capital gains tax liability, you may still be subject to depreciation recapture. This means that any depreciation deductions you previously claimed on the relinquished property will be taxed at a higher rate when you sell the replacement property. It is essential to consult with a tax professional to fully understand the potential tax implications.

Lastly, a 1031 exchange may limit your flexibility in terms of timing and reinvestment options. Once you identify a replacement property, you are committed to purchasing it within the specified timeframe. If you fail to close on the replacement property within 180 days, the exchange may be invalidated, and you may be liable for capital gains taxes. Additionally, the exchange requires reinvestment of the entire proceeds from the sale, making it challenging to access funds for other purposes.

Frequently Asked Questions

Can a 1031 Exchange Be Used for Personal Property or Only for Real Estate?

A 1031 exchange can only be used for real estate, not personal property. It allows you to defer taxes on the sale of investment property by reinvesting the proceeds into a similar property.

What Is the Timeline for Completing a 1031 Exchange?

To complete a 1031 exchange, you must identify a replacement property within 45 days and close on it within 180 days from the sale of your original property. It’s crucial to adhere to this timeline to enjoy the tax advantages.

Are There Any Limitations on the Types of Properties That Can Be Exchanged in a 1031 Exchange?

Sure! There are indeed limitations on the types of properties that can be exchanged in a 1031 exchange. Generally, only real estate properties held for investment or business purposes can qualify.

Can a 1031 Exchange Be Used to Defer State and Local Taxes, or Only Federal Taxes?

Yes, a 1031 exchange can be used to defer both state and local taxes, as well as federal taxes. This tax strategy allows you to reinvest your capital gains into a similar property, deferring tax obligations.

Are There Any Circumstances Where a 1031 Exchange Can Be Disqualified or Reversed?

Under certain circumstances, a 1031 exchange can be disqualified or reversed. For example, if you fail to meet the strict deadlines or use the proceeds for personal use, the exchange may be invalidated.