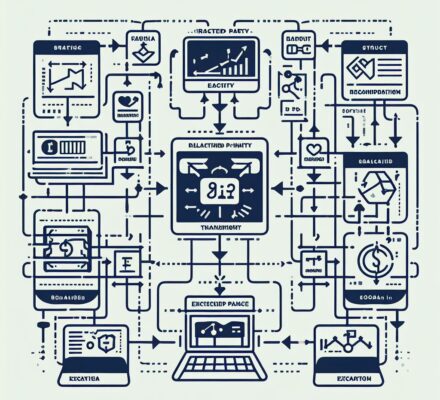

Imagine you’re navigating a complex maze of regulations and guidelines, all in pursuit of a successful 1031 exchange. But what happens when the other party involved is a related party?

In this article, we’ll unravel the structure for related party transactions in 1031 exchanges. From understanding IRS rules to identifying related parties, we’ll guide you through the required documentation and potential challenges.

So grab a pen and get ready to conquer this intricate terrain!

Key Takeaways

- Related party transactions in a 1031 exchange involve buying or selling property between individuals or entities with a pre-existing relationship.

- IRS rules and regulations govern related party transactions in a 1031 exchange, including the requirement that related parties hold the property for a minimum of two years following the exchange.

- Compliance with IRS rules and regulations, including conducting transactions at arm’s length and properly reporting to the IRS, is crucial for the validity of the 1031 exchange.

- Key challenges in related party transactions include addressing potential conflicts of interest, obtaining independent appraisals to determine fair market value, planning and coordinating transactions in advance to allow sufficient time, and maintaining meticulous records to substantiate the validity of the exchange.

Definition of Related Party Transactions

To understand the structure for related party transactions in a 1031 exchange, you need to familiarize yourself with the definition of these transactions. Related party transactions refer to the buying or selling of property between individuals or entities that have a pre-existing relationship. These relationships can include family members, business partners, or any other parties that are connected through a common interest.

In a 1031 exchange, the Internal Revenue Service (IRS) has specific rules and regulations that govern related party transactions. The main objective is to prevent individuals from taking advantage of the tax benefits associated with a 1031 exchange by engaging in transactions with related parties solely for tax purposes.

According to the IRS, related party transactions are subject to greater scrutiny and must meet certain requirements to qualify for a 1031 exchange. The related parties involved must hold the property for a minimum of two years following the exchange, and they can’t dispose of the property to an unrelated party within that time frame. Additionally, the fair market value of the property must be accurately determined to ensure compliance with IRS regulations.

Understanding the definition of related party transactions is crucial in navigating the structure of a 1031 exchange. By adhering to the IRS guidelines, individuals can take advantage of the tax benefits while ensuring compliance with the regulations.

IRS Rules and Regulations

To ensure compliance with the regulations, you must understand the IRS rules and regulations governing related party transactions in a 1031 exchange. These rules are designed to prevent abuse and ensure fair treatment in such transactions.

Here are the key IRS rules and regulations you need to be aware of:

- Arm’s Length Requirement: All related party transactions in a 1031 exchange must be conducted at arm’s length. This means that the transaction should be carried out as if the parties involved were unrelated and acting in their own best interests.

- Prohibition on Self-Dealing: The IRS prohibits self-dealing in related party transactions. This means that you can’t use the 1031 exchange to transfer property to a related party for personal use or benefit. The purpose of the exchange must be for investment or business purposes.

- Reporting Requirements: Related party transactions must be properly reported to the IRS. You must disclose all relevant information, including the identities of the related parties, the nature of the transaction, and the fair market value of the property exchanged.

Understanding and adhering to these IRS rules and regulations is crucial to ensure the validity of your 1031 exchange.

Now that you have a grasp of the IRS rules and regulations, let’s move on to the next section about identifying related parties.

Identifying Related Parties

Now that you understand the IRS rules and regulations governing related party transactions in a 1031 exchange, let’s delve into the process of identifying related parties. It is crucial to accurately identify related parties to ensure compliance with the IRS guidelines. Related parties are individuals or entities that have a close relationship with the taxpayer, such as family members, business partners, or corporations with common ownership. To help you identify related parties, refer to the following table:

| Related Party | Description |

|---|---|

| Family Members | Includes spouse, parents, grandparents, children, and siblings. |

| Business Partners | Refers to individuals or entities with whom you have an ongoing business relationship. |

| Corporations with Common Ownership | Involves entities that share a significant ownership interest or are under common control. |

Required Documentation and Reporting

Proper documentation and reporting are essential for ensuring compliance with IRS guidelines in related party transactions within a 1031 exchange. When engaging in a related party transaction, it’s important to keep accurate records and report the necessary information to the IRS.

Here are the key documents and reporting requirements you need to be aware of:

- Sales Agreement: This document outlines the terms and conditions of the transaction between the related parties. It should include the purchase price, closing date, and any special conditions or contingencies.

- Qualified Intermediary Agreement: In a 1031 exchange, a qualified intermediary (QI) is typically used to facilitate the transaction. The QI agreement outlines the roles and responsibilities of the QI, including the handling of funds and the transfer of properties.

- Form 8824: This form is used to report like-kind exchanges to the IRS. It must be filed for all related party transactions within a 1031 exchange. The form requires detailed information about the properties involved, the parties involved, and the financial aspects of the transaction.

Potential Challenges and Pitfalls

Navigating potential challenges and pitfalls is crucial when engaging in related party transactions within a 1031 exchange. While these transactions can offer certain advantages, there are also several factors that need to be carefully considered to ensure compliance with tax regulations and avoid any potential issues. The table below provides an overview of some common challenges and pitfalls that may arise in related party transactions within a 1031 exchange, along with corresponding strategies to mitigate them:

| Challenge/Pitfall | Strategy |

|---|---|

| Conflict of Interest | Establish clear guidelines and procedures to address any potential conflicts of interest between the parties involved. |

| Fair Market Value | Obtain independent appraisals to determine the fair market value of the properties involved, ensuring that the exchange is conducted at arms’ length. |

| Timing Constraints | Plan and coordinate the transactions well in advance to allow sufficient time for due diligence, negotiations, and necessary documentation. |

| IRS Scrutiny | Maintain meticulous records and documentation to substantiate the validity of the 1031 exchange and related party transactions, in case of an IRS audit or examination. |

Frequently Asked Questions

Are There Any Specific Time Limits or Deadlines for Completing a Related Party Transaction in a 1031 Exchange?

There are specific time limits and deadlines for completing a related party transaction in a 1031 exchange. The Internal Revenue Code provides that the exchange must be completed within 180 days.

Can a Related Party Transaction Be Conducted With a Foreign Entity or Individual?

Yes, a related party transaction can be conducted with a foreign entity or individual. However, it is important to comply with all the rules and regulations regarding related party transactions in a 1031 exchange.

Are There Any Limitations on the Types of Properties That Can Be Exchanged in a Related Party Transaction?

There are limitations on the types of properties that can be exchanged in a related party transaction. The IRS prohibits exchanges of inventory, stocks, bonds, partnership interests, and certain other assets.

What Happens if the Fair Market Value of the Property in a Related Party Transaction Is Disputed by the Irs?

If the IRS disputes the fair market value of the property in a related party transaction, you could end up in a never-ending battle of paperwork and headaches. It’s like a never-ending merry-go-round of frustration.

Are There Any Tax Consequences or Implications for Engaging in Multiple Related Party Transactions Within a Certain Time Period?

Engaging in multiple related party transactions within a certain time period can have tax consequences or implications. It is important to consult with a tax professional to understand the specific implications in your situation.