Imagine if you could legally defer capital gains tax, increase your cash flow, diversify your portfolio, accumulate wealth, and plan your estate more effectively. Well, with 1031 exchanges, you can!

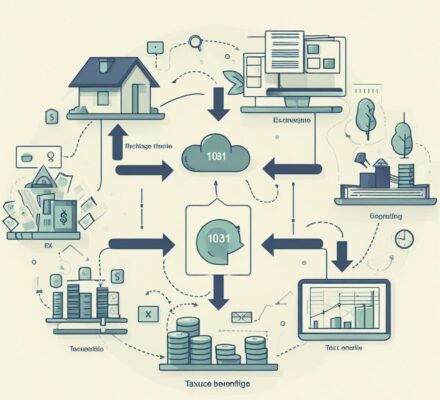

This tax strategy allows you to exchange one investment property for another, while deferring the payment of capital gains tax. By utilizing this technique, you can take advantage of the five best tax benefits it offers.

So, let’s dive into the details and explore how 1031 exchanges can benefit you.

Key Takeaways

- Deferring capital gains tax through 1031 exchanges

- Utilizing the power of compounding and potential higher returns

- Increased flexibility and liquidity in managing investments

- Strategic use of 1031 exchanges to defer taxes for maximum growth

Tax-deferred Capital Gains

One of the best tax advantages of a 1031 exchange is that you can defer your capital gains tax. When you sell an investment property and use the proceeds to acquire a like-kind property through a 1031 exchange, you can defer paying taxes on the capital gains you have made. This means that instead of immediately paying taxes on the profits you have earned, you can reinvest that money into a new property and continue to grow your investment portfolio.

By deferring your capital gains tax, you’re able to keep more money working for you in the real estate market. This allows you to take advantage of the power of compounding and potentially generate greater returns over time. Additionally, deferring taxes can provide you with more flexibility and liquidity in managing your investments.

It’s important to note that the tax deferral isn’t a permanent exemption. Eventually, when you sell the replacement property without going through another 1031 exchange, you’ll have to pay the capital gains tax. However, by strategically utilizing 1031 exchanges, you can potentially defer taxes for many years and maximize your investment growth.

Increased Cash Flow

To further enhance your financial situation, another benefit of utilizing a 1031 exchange is the potential for increased cash flow. When you sell a property through a 1031 exchange and reinvest the proceeds into a new property, you have the opportunity to increase your monthly rental income. This can be achieved in several ways.

Firstly, by exchanging into a property with higher rental rates, you can immediately boost your cash flow. For example, if you currently own a residential property with low rental rates, you can exchange it for a commercial property that commands higher rent. This will result in a higher monthly income and increased cash flow.

Secondly, you can use a 1031 exchange to upgrade to a newer property that requires less maintenance and repair costs. By investing in a property that’s in better condition, you can minimize your expenses and increase your net rental income. This will directly contribute to an improved cash flow.

Lastly, a 1031 exchange allows you to diversify your real estate portfolio. By exchanging into multiple properties, you can spread your rental income across different assets. This diversification can help protect your cash flow from potential risks associated with a single property, such as vacancies or non-payment of rent.

Portfolio Diversification

To further strengthen your investment strategy, consider the tax advantages of 1031 exchanges for portfolio diversification. By utilizing a 1031 exchange, you can defer capital gains taxes and reinvest the proceeds from the sale of one property into another property, allowing you to diversify your real estate holdings without incurring a hefty tax burden. This strategy offers several benefits, including the ability to spread risk across different types of properties and locations, potentially increasing your overall returns.

To illustrate the potential benefits of portfolio diversification through 1031 exchanges, consider the following hypothetical scenario:

| Property Type | Location | Estimated Value |

|---|---|---|

| Apartment | New York City | $2,000,000 |

| Office | Chicago | $1,500,000 |

| Retail | Los Angeles | $1,800,000 |

In this scenario, if you were to sell one of the properties and reinvest the proceeds into the remaining two properties using a 1031 exchange, you would effectively spread your investment across different property types and markets. This can help mitigate the risk associated with any one property or location, while potentially increasing the potential for growth and income generation.

Wealth Accumulation

To continue building your wealth through 1031 exchanges, take advantage of the tax benefits and reinvest the proceeds from your property sales into new investments. By doing so, you can maximize your potential for wealth accumulation. Here are three key strategies to consider:

- Leverage the power of compounding: Reinvesting your proceeds allows you to take advantage of compounding returns. By continuously reinvesting, you can potentially earn returns not just on your original investment, but also on the accumulated returns over time.

- Explore high-growth opportunities: 1031 exchanges provide you with the flexibility to diversify your investments and explore new markets or property types with higher growth potential. By carefully selecting properties that align with your investment goals, you can increase your chances of wealth accumulation.

- Minimize tax liabilities: One of the significant advantages of 1031 exchanges is the ability to defer capital gains taxes. By reinvesting your proceeds into new investments, you can avoid immediate tax consequences and keep more of your money working for you.

By understanding and utilizing these wealth accumulation strategies, you can take full advantage of the tax benefits offered by 1031 exchanges and continue to grow your wealth.

Now, let’s explore the estate planning benefits of this tax strategy.

Estate Planning Benefits

Maximize your estate planning by utilizing the tax advantages of 1031 exchanges. When it comes to estate planning, preserving wealth and minimizing taxes are crucial. A 1031 exchange can be a powerful tool in achieving these goals. By deferring capital gains taxes on the sale of investment property, you can preserve more of your wealth for future generations.

One of the key estate planning benefits of a 1031 exchange is the ability to pass on a larger estate to your heirs. By deferring the payment of capital gains taxes, you can keep more of your investment property’s value within your estate. This can allow you to pass on a substantially larger inheritance to your loved ones.

Additionally, a 1031 exchange can help you maintain control over your estate. By deferring taxes, you can keep your investment property intact and continue to generate income from it. This can be especially beneficial if you have a property that has been generating significant cash flow.

Furthermore, a 1031 exchange can provide flexibility in your estate planning strategy. You can exchange into different types of investment properties, such as commercial real estate or rental properties, depending on your goals and preferences.

Frequently Asked Questions

Can I Use a 1031 Exchange to Defer Taxes on the Sale of a Primary Residence?

No, you cannot use a 1031 exchange to defer taxes on the sale of a primary residence. 1031 exchanges are specifically for investment properties and are not applicable to primary residences.

Are There Any Time Limitations for Completing a 1031 Exchange?

There are time limitations for completing a 1031 exchange. The exchange must be completed within 180 days of selling the property, or the due date of the tax return, whichever is earlier.

What Happens if I Cannot Find a Replacement Property Within the Specified Time Frame?

If you cannot find a replacement property within the specified time frame, you may be subject to paying capital gains taxes on the sale of your original property. It’s important to carefully plan and execute your 1031 exchange to avoid this outcome.

Can I Exchange a Property in One State for a Property in Another State Using a 1031 Exchange?

Yes, you can exchange a property in one state for a property in another state using a 1031 exchange. It allows you to defer capital gains taxes by reinvesting the proceeds into a similar investment property.

Are There Any Restrictions on the Types of Properties That Can Be Exchanged Under a 1031 Exchange?

There are no restrictions on property types for a 1031 exchange. You can exchange any property, from a small condo to a big commercial building. It’s a flexible and powerful tax strategy.